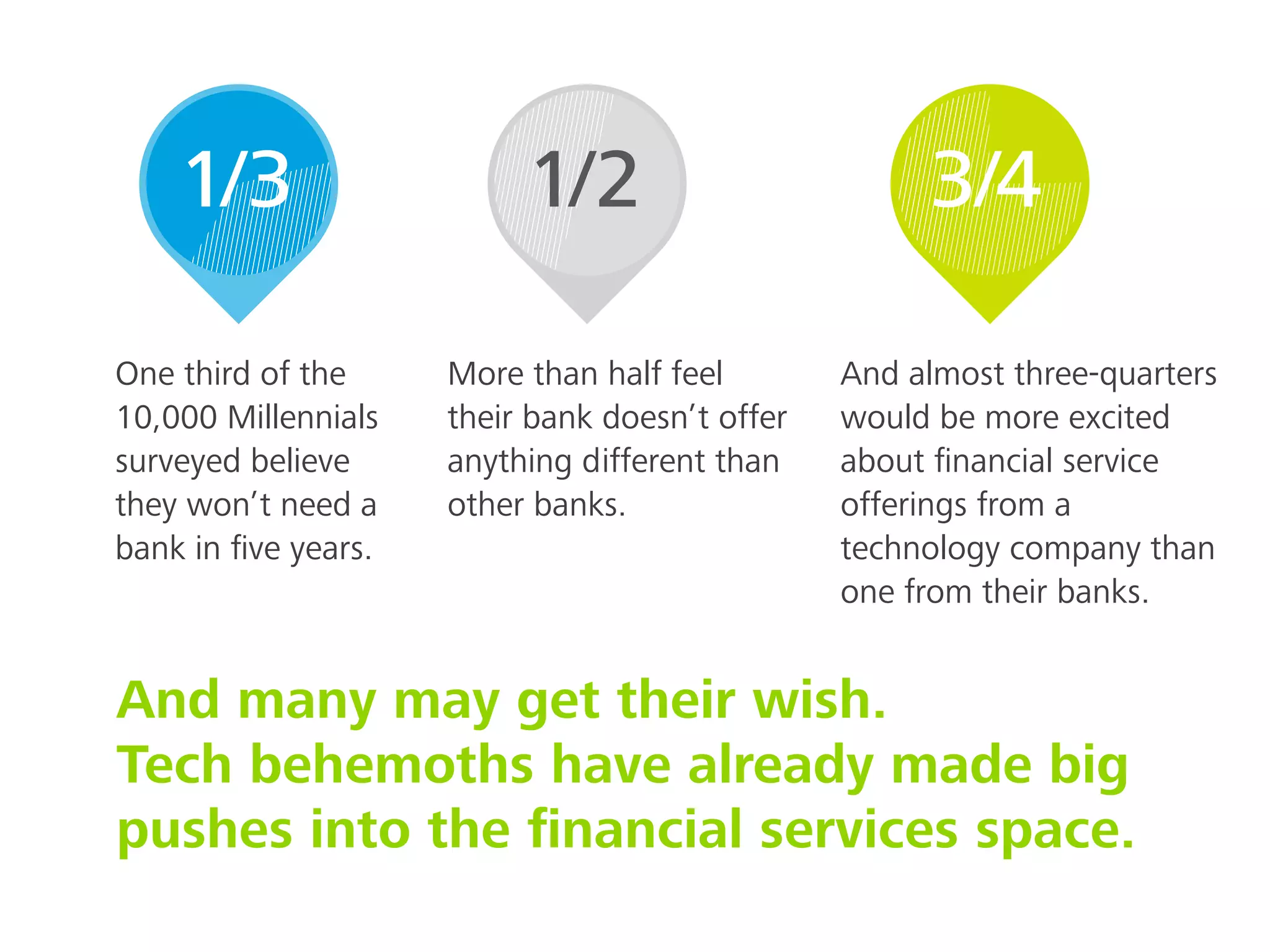

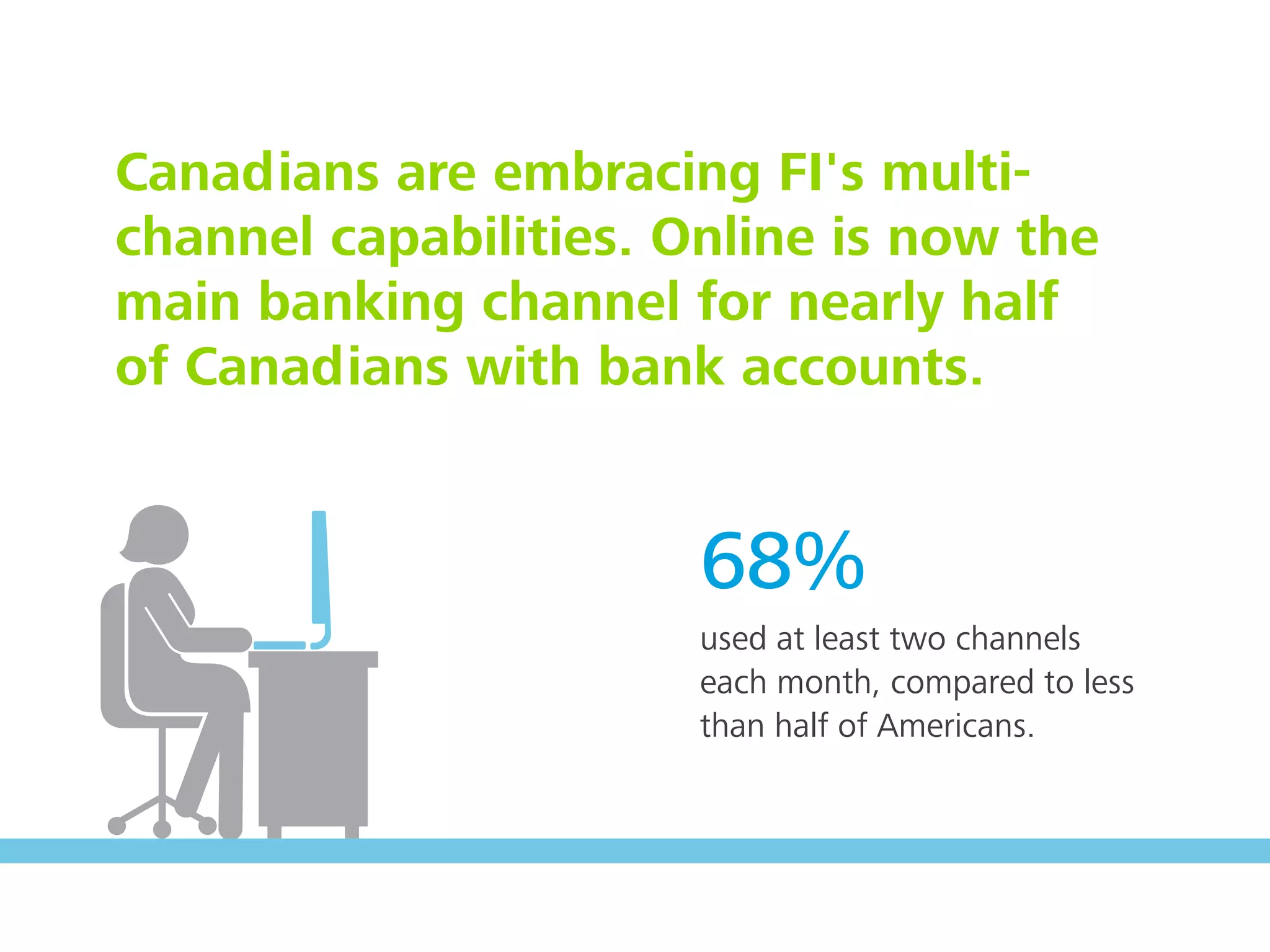

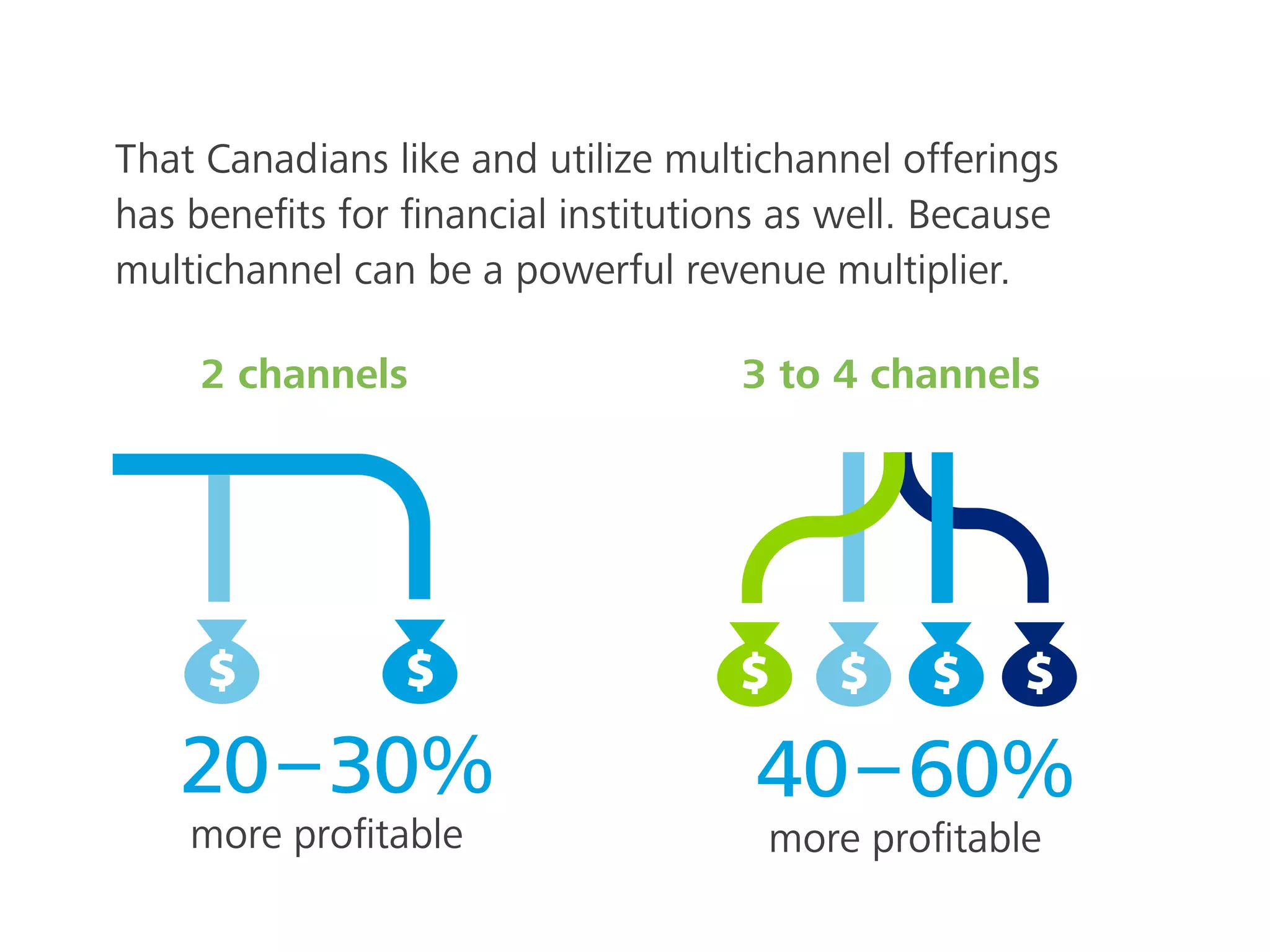

Canadian financial institutions are investing in multichannel capabilities to enhance customer experience, yet many struggle to meet the evolving expectations of tech-savvy and demanding consumers, particularly millennials. To succeed, financial services must shift their focus from products to understanding customer needs, streamline processes, and innovate by learning from retail sectors. Additionally, adapting real estate strategies and reorganizing for a customer-centric approach are essential for long-term profitability and satisfaction.