Latin America Aviation Market

Monthly Latin American Airline Data Updates

Discover the Busiest Airports and Airlines in Latin America This Month | November 2025

How much airline capacity is there in Latin America? Find out with new data each month.

Here are some of the top statistics from Latin America's aviation market this month:

- Busiest Airport: Bogata

- Largest airline: LATAM

- Latin American country with most global airline capacity: Brazil

- Largest regional market: Lower South America

Airline Capacity in Latin America | November 2025

In Latin America this month there are 153 airlines with scheduled capacity and 537 airports

How much airline capacity is there in latin america?

- Overall capacity for Latin America has increased by 3.8% to 51.1 million seats in November 2025.

- International and domestic capacity grew at a similar rate this month of 3.8% and 3.7% respectively vs last year.

- Mainline carriers represent 64% of the market and grew by 3.7% vs November 2024, whilst LCCs grew by 3.9% year on year and account for 18.4 million seats.

*As of July 2025, international capacity is reported on a two-way basis (previously one-way departing).

WE'LL LET YOU KNOW WHEN NEW DATA IS ADDED

Add your name to the list and we'll email you once a week with a round-up of the new aviation data added to our dashboards, the latest in-depth analysis from our air travel experts, travel technology news, easy to digest infographics and more.

Country Aviation Markets in Latin America | November 2025

Which Latin American Country Has The Most Airline Capacity (Domestic + International)?

- Brazil remains the largest country market with 11.9m seats, growing by 6.9% vs last year.

- Capacity in Panama grew at the fastest rate of 12.4% vs last year, followed by Argentina by 7.4%.

- Capacity in Chile reduced most again this month by 8.1%, 191,400 fewer seats.

Which Latin American Country Has THE Most DOMESTIC Airline Capacity?

- Brazil is the largest domestic market with 10.5 million seats, increasing capacity by 6.5% (640,000 additional seats) vs November 2024.

- Venezuela saw the fastest domestic capacity growth this month, with a 22.4% increase, adding 62,200 seats compared to November 2024. In contrast, domestic capacity fell by 184,000 seats in Chile and by 89,400 seats in Bolivia year over year.

Top Ten Busiest Airports by Departing Seats in Latin America | November 2025

Which is the Busiest Airport in Latin America?

- Bogota is the busiest airport in the region with 2.5m seats. This reflects Colombia's steady growth as the third-largest market in Latin America, as discussed in OAG's Colombia-focused webinar in October.

- Among the Top 10 largest airports in Latin America, Rio de Janeiro saw the highest growth, increasing by 19.8% compared to November 2024.

Airline Capacity by Region | November 2025

Which Region of Latin America Has Most AIRLINE Capacity?

- Lower South America is the largest market, with 16.8 million seats to/from the region.

- Central America is the second largest market, growing by 821,900 seats this month to reach a total of 12.5 million seats in November 2025.

- Connectivity Across the Continent: A Deeper Look at Latin America | Read Now

Where do flights from Latin America go?

- North America is the largest market with 13.2m seats, 432,900 additional seats vs November 2024.

- Capacity within Latin America is the next largest market with 6.3m seats and an increase of 383,800 seats vs last year.

- Whilst remaining small markets, international capacity to the Middle East and Asia Pacific grew at the fastest rates of 26% and 22% respectively vs last year.

Top Ten Airlines in Latin America (Departing Seats, One-way) | November 2025

Which is the biggest airline in Latin America?

- LATAM Airline Group is the largest carrier in Latin America, offering 8.6 million seats this month - an increase of 5.8%, or 475,100 more seats than last month.

- Jetsmart made the largest percentage increase in capacity again this month of 29.5% (354,100 additional seats), followed by GOL Linhas Aereas with a 17.8% increase (555,000 additional seats).

- Azul Airlines and Aeromexico reduced capacity by 5.9% and 1.5% respectively.

MORE RESOURCES FROM OAG

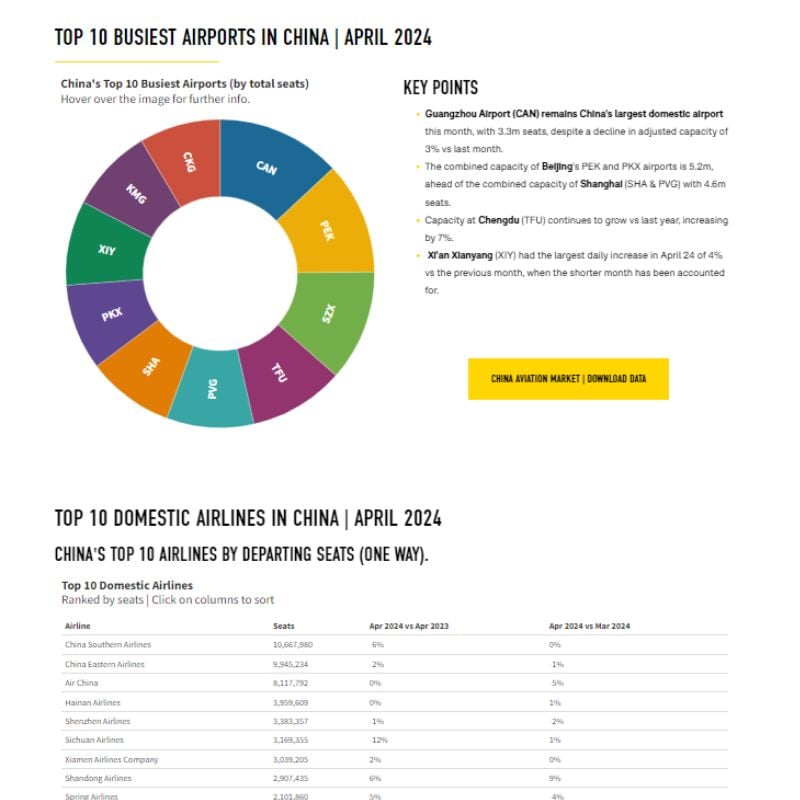

China Aviation market Data

The busiest airports, largest airlines, biggest cities for airline capacity and more

View Data

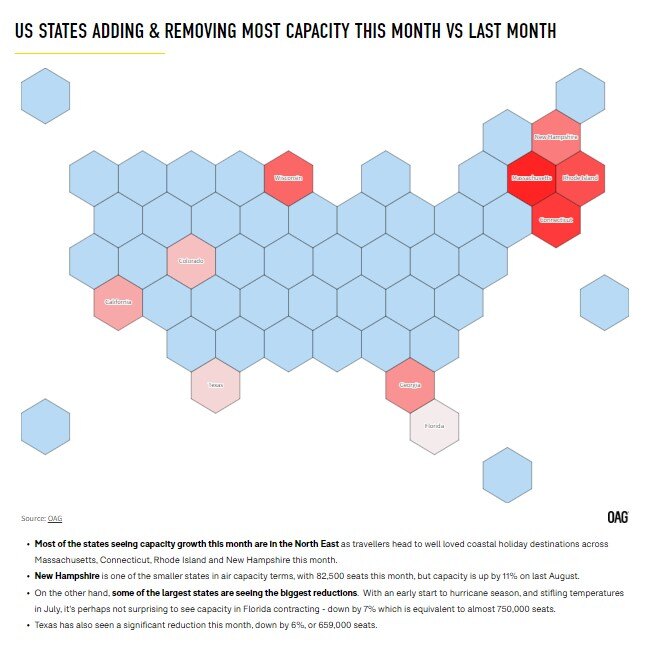

US Aviation Market Data

This month's leading airlines, airports, states and more from the US market.

View Data

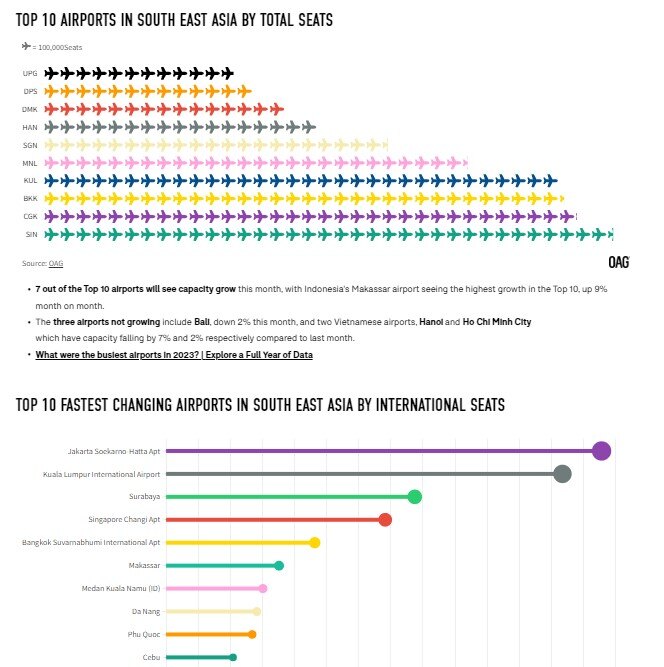

South East Asian Aviation Market Data

SE Asia's biggest country markets, airports, airlines and more are updated each month.

View Data

Aviation Market Analysis

Analysis of the latest data and developments in the aviation world.

Read Now