- Home

- »

- Agrochemicals & Fertilizers

- »

-

Smart Fertilizers Market Size & Share, Industry Report, 2033GVR Report cover

![Smart Fertilizers Market Size, Share & Trends Report]()

Smart Fertilizers Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Sulfur Coated Fertilizers, Chemical Compounds), By Application (Grains and Cereals, Commercial Crops), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-782-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Fertilizers Market Summary

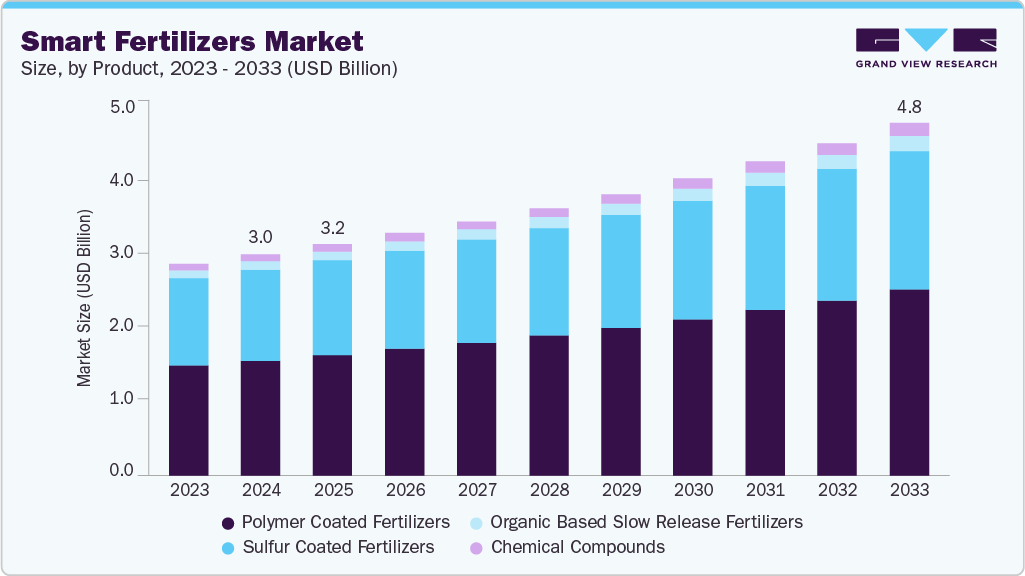

The global smart fertilizers market size was estimated at USD 3,024.6 million in 2024 and is projected to reach USD 4,815.3 million by 2033, growing at a CAGR of 5.4% from 2025 to 2033. The market is expanding rapidly, driven by the need for sustainable agriculture and efficient nutrient management.

Key Market Trends & Insights

- Asia Pacific led the smart fertilizers market in 2024 with the revenue share of 37.2%.

- The smart fertilizers market in China dominated the Asia Pacific due to its large-scale agricultural production and high population-driven food demand.

- By product, polymer coated fertilizers dominated the market and accounted for the largest revenue share of 52.0% in 2024.

- By application, fruits and vegetables segment is expected to grow fastest with a CAGR of 6.9% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 3,024.6 Million

- 2033 Projected Market Size: USD 4,815.3 Million

- CAGR (2025-2033): 5.4%

- Asia Pacific: Largest market in 2024

These advanced fertilizers, including controlled-release and bio-based options, offer precise nutrient delivery, reducing environmental impact and enhancing crop yields. Smart fertilizers are essential for modern farming practices as global food demand rises.The increasing global population, which intensifies the demand for food production, drives market growth. Traditional farming methods often lead to nutrient runoff and environmental degradation. Smart fertilizers address these issues by releasing nutrients in sync with plant needs, minimizing waste and environmental harm. This efficiency supports sustainable farming and aligns with global initiatives to reduce agriculture's ecological footprint. Technological advancements play a pivotal role in the adoption of smart fertilizers. Integrating sensors, drones, and data analytics allows for real-time monitoring and precise fertilizer application. These innovations enable farmers to optimize fertilizer use, improving crop productivity while conserving resources. As precision agriculture becomes more prevalent, the demand for smart fertilizers is expected to rise, further driving market expansion.

The market is also influenced by regulatory support and consumer preferences. Governments worldwide are implementing policies promoting sustainable farming practices, including using environmentally friendly fertilizers. In addition, consumers increasingly seek food produced with minimal environmental impact, encouraging farmers to adopt smart fertilization methods.

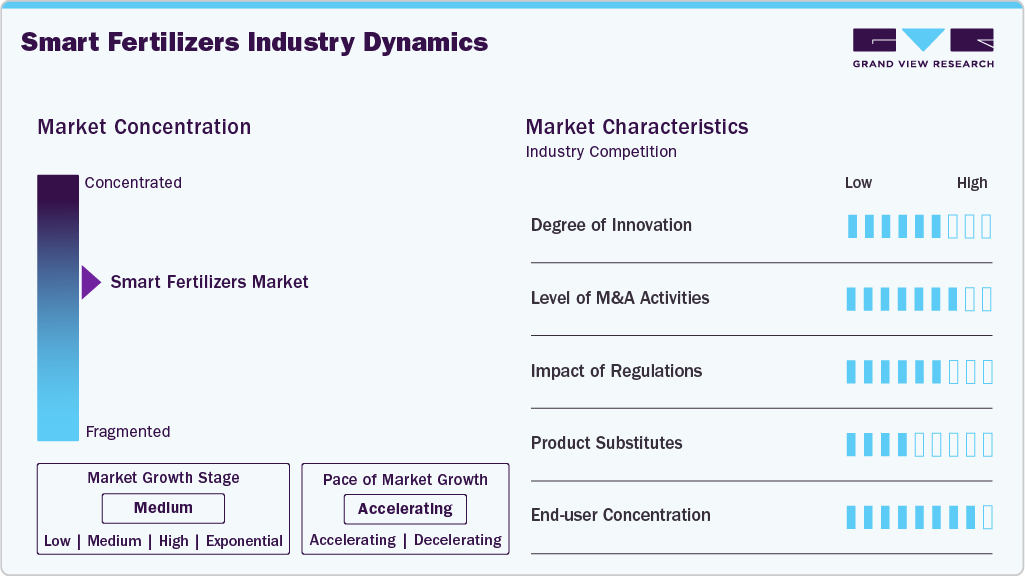

Market Concentration & Characteristics

The smart fertilizers industry is characterized by a mix of established global players and emerging regional companies, resulting in a moderately concentrated landscape. Major manufacturers leverage advanced formulations and research capabilities to maintain a competitive edge, while smaller firms focus on niche products and localized solutions. This combination fosters innovation and market diversity, encouraging the development of products tailored to specific crops, soil types, and environmental conditions.

Market characteristics reflect a strong emphasis on efficiency and sustainability. Products are designed to optimize nutrient delivery, minimize environmental impact, and improve crop yields, which aligns with growing agricultural and ecological demands. Relationships between suppliers, distributors, and farmers are increasingly collaborative, emphasizing knowledge sharing and technical support. The market is also influenced by regulatory frameworks promoting eco-friendly practices, shaping product development and adoption. The market exhibits dynamic growth potential, driven by evolving agricultural practices and environmental considerations.

Product Insights

Polymer coated fertilizers dominated the market and accounted for the largest revenue share of 52.0% in 2024 due to their ability to provide controlled nutrient release, ensuring crops receive essential nutrients over an extended period. This efficiency reduces nutrient losses and enhances crop yields, making it highly attractive to large-scale farmers. Its widespread adoption across major agricultural regions and proven performance in diverse soil conditions contributed to its dominant revenue share in 2024.

The organic-based slow-release fertilizers segment is expected to grow fastest, with a CAGR of 6.8% from 2025 to 2033. This segment is projected to experience the fastest growth, driven by increasing demand for sustainable and eco-friendly farming solutions. Farmers seek alternatives that improve soil health while minimizing chemical runoff, and organic formulations meet these requirements. Growing awareness of environmental impact and regulatory support for natural inputs further accelerate adoption, making this segment a high-potential area within the market.

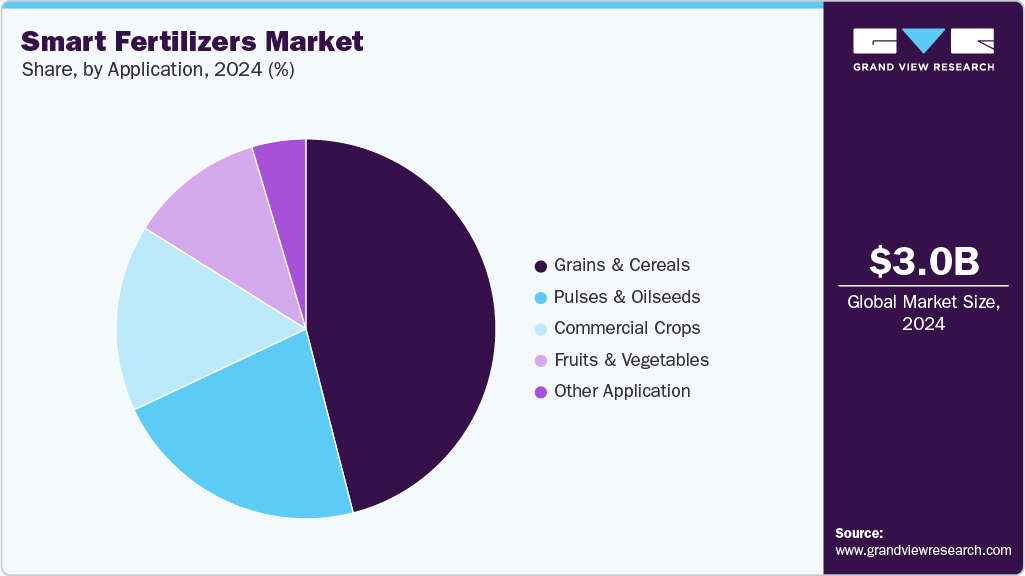

Application Insights

Grains and cereals dominated the market and accounted for the largest revenue share of 46.0% in 2024. The segment held the largest share due to the extensive cultivation of staple crops such as wheat, rice, and maize worldwide. These crops require high nutrient inputs to ensure consistent yields, and smart fertilizers offer precise nutrient delivery, reducing losses and improving efficiency. Large-scale adoption in major producing regions and the critical role of grains in global food security contributed to its dominant market revenue in 2024.

Fruits and vegetables is expected to grow fastest with a CAGR of 6.9% from 2025 to 2033. The segment is anticipated to grow rapidly, driven by the increasing demand for high-quality, nutrient-rich produce. Farmers are adopting smart fertilizers to enhance yield, improve shelf life, and maintain crop quality, particularly in intensive horticulture systems. The growing focus on sustainable farming practices and reducing chemical runoff further supports the adoption of precision fertilizers in this segment, positioning it as the fastest-growing category in the market.

Regional Insights

Asia Pacific led the smart fertilizers market in 2024 with the revenue share of 37.2% due to its vast agricultural landscape, particularly in countries like China and India, which are major rice, wheat, and maize producers. High population density and increasing food demand drive farmers to adopt efficient nutrient management practices. Government initiatives supporting sustainable agriculture and the growing focus on improving crop yields have strengthened the region’s dominance in smart fertilizer adoption.

China Smart Fertilizers Market Trends

The smart fertilizers market in China dominated the Asia Pacific due to its large-scale agricultural production and high population-driven food demand. Farmers are shifting toward efficient nutrient management to maximize yield and reduce soil degradation caused by traditional fertilizers. Government subsidies, environmental regulations targeting chemical runoff, and initiatives promoting eco-friendly farming practices are accelerating the country's adoption of polymer-coated and organic-based slow-release fertilizers.

North America Smart Fertilizers Market Trends

The smart fertilizers market in North America is projected to witness the fastest growth due to the rising adoption of precision agriculture and advanced farming practices. Farmers increasingly rely on smart fertilizers to optimize nutrient use, reduce environmental impact, and comply with strict agricultural regulations. In addition, higher disposable income, government incentives, and a growing focus on sustainable crop production encourage the integration of controlled-release and bio-based fertilizers across major farming regions.

The U.S. smart fertilizers market is growing steadily due to the widespread adoption of precision agriculture and advanced farming practices. Farmers increasingly use controlled-release and bio-based fertilizers to optimize nutrient application, improve crop yields, and reduce environmental impact. Regulatory policies promoting sustainable agriculture and strong investment in research and development support the uptake of smart fertilizers across major crops such as corn, soybeans, and wheat.

Europe Smart Fertilizers Market Trends

The smart fertilizers market in Europe is shaped by strict environmental regulations and a strong focus on sustainable farming. Farmers are increasingly adopting smart fertilizers to comply with nutrient runoff limits, improve soil health, and maintain high crop quality. Supportive policies under the European Green Deal and growing consumer demand for sustainably produced food drive the growth of bio-based and controlled-release fertilizers across cereals, vegetables, and specialty crops.

Latin America Smart Fertilizers Market Trends

The smart fertilizers market in Latin America is witnessing growth in smart fertilizers due to the region’s reliance on export-oriented agriculture, particularly soybeans, coffee, and sugarcane. Farmers are adopting advanced fertilizers to enhance yield and maintain soil fertility in tropical soils prone to nutrient leaching. Increasing awareness of sustainable practices, investments in agri-input infrastructure, and partnerships with global suppliers fuel market expansion.

Middle East & Africa Smart Fertilizers Market Trends

The smart fertilizers market in the MEA is expanding gradually due to arid conditions and limited arable land, which makes efficient nutrient management critical. Smart fertilizers help optimize crop productivity while conserving water and reducing fertilizer losses. Governments are promoting sustainable agriculture through initiatives to improve food security, and adoption is supported by targeted solutions for high-value crops like fruits, vegetables, and horticulture in regions facing harsh climatic conditions.

Key Smart Fertilizers Company Insights

The two key dominant manufacturers in the market are BASF SE and Nutrien Ltd.

-

BASF SE is a global chemical company renowned for its innovation in agriculture, particularly in advanced fertilizers. Its research focuses on creating solutions that enhance nutrient efficiency and reduce environmental impact, positioning it as a leader in sustainable farming practices.

-

Nutrien Ltd. is a leading agricultural company recognized for developing smart fertilizers that improve nutrient delivery and crop performance. Its focus on innovative solutions addresses yield optimization and environmental sustainability in modern agriculture.

Key Smart Fertilizers Companies:

The following are the leading companies in the smart fertilizers market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Nutrien Ltd.

- ICL Group

- Haifa Chemicals

- Yara International

- Dakota

- The Mosaic Company

- Haifa Group

- K+S Aktiengesellschaft

Recent Developments

-

In April 2024, Nitricity Inc. launched its first tonnage field test of locally-produced liquid calcium nitrate in Madera County, California, partnering with Olam Food Ingredients, Elemental Excelerator, and the Madera/Chowchilla RCD to scale climate-smart nitrogen fertilizer production.

-

In November 2023, UGM launched its Super Smart Fertilizer (SSF), which was applied at PT Pagilaran tea plantation. Trials in Pagilaran and Kalilandak showed that tea shoot production increased up to threefold, with the highest yield rising 320 percent, boosting overall harvests significantly.

Smart Fertilizers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3,162.8 million

Revenue forecast in 2033

USD 4,815.3 million

Growth rate

CAGR of 5.4% from 2025 to 2033

Actual data

2018 - 2024

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue & Volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Brazil; Argentina; Germany; UK; Italy; Spain; France; China; Japan; South Korea; Saudi Arabia; South Africa

Key companies profiled

BASF SE; Nutrien Ltd.; ICL Group; Haifa Chemicals; Yara International; Dakota; The Mosaic Company; Haifa Group; K+S Aktiengesellschaft

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Fertilizers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global smart fertilizers market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Polymer Coated Fertilizers

-

Sulfur Coated Fertilizers

-

Organic Based Slow Release Fertilizers

-

Chemical Compounds

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Grains & Cereals

-

Pulses & Oilseeds

-

Commercial Crops

-

Fruits & Vegetables

-

Other Application

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global smart fertilizers market size was estimated at USD 3,024.6 million in 2024 and is expected to reach USD 3,162.8 million in 2025.

b. The smart fertilizers market is expected to grow at a compound annual growth rate of 5.4% from 2025 to 2033, reaching USD 4,815.3 million by 2033.

b. The Polymer-Coated Fertilizers segment accounted for the largest share of the smart fertilizers market by product. This segment dominates due to its ability to provide controlled nutrient release, improve nutrient use efficiency, reduce environmental losses, and enhance crop yields across a wide variety of crops.

b. Some of the key players operating in the smart fertilizers market include BASF SE, Nutrien Ltd., ICL Group, Haifa Chemicals, Yara International, Dakota, The Mosaic Company, Haifa Group, K+S Aktiengesellschaft.

b. The smart fertilizers market is growing due to rising global food demand, the need for sustainable agriculture, efficient nutrient management, environmental regulations, and increasing adoption of precision farming practices that enhance crop yield while minimizing nutrient losses and ecological impact.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.