- Home

- »

- Agrochemicals & Fertilizers

- »

-

Middle East Potash Market Size, Share, Industry Report 2033GVR Report cover

![Middle East Potash Market Size, Share & Trends Report]()

Middle East Potash Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Potassium Chloride, Potassium Sulphate, Potassium Nitrate), By End-use, By Country (Saudi Arabia, UAE, Qatar, Israel), And Segment Forecasts

- Report ID: GVR-4-68040-733-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Potash Market Summary

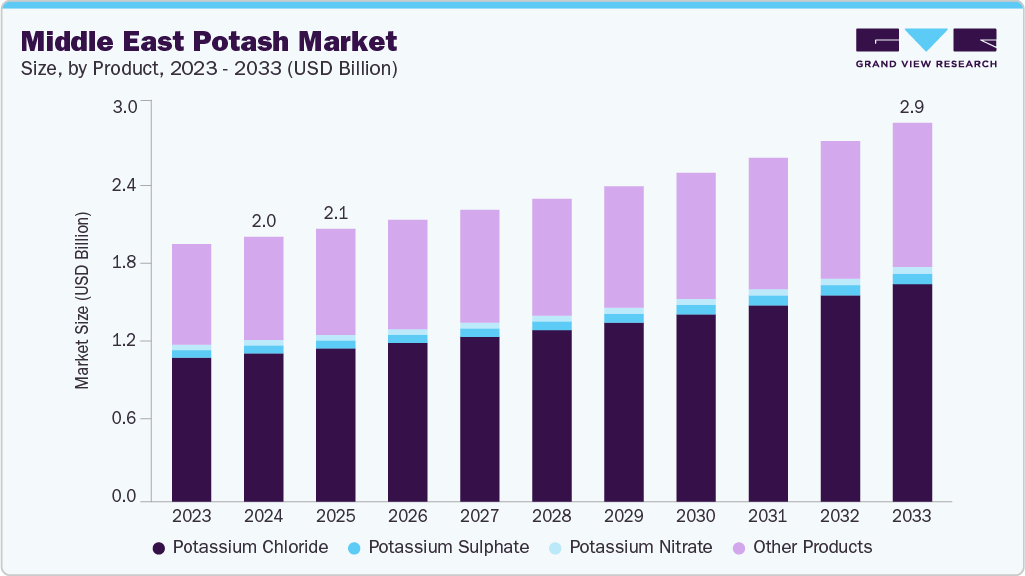

The Middle East potash market size was estimated at USD 2,020.7 million in 2024 and is projected to reach USD 2,892.2 million by 2033, growing at a CAGR of 4.2% from 2025 to 2033. The market growth is driven by the increasing adoption of precision agriculture and fertigation techniques, fueled by water scarcity and saline soil conditions across the region.

Key Market Trends & Insights

- The potash market in Israel is expected to grow at the fastest CAGR of 3.8% from 2025 to 2033 in terms of volume.

- By product, the potassium chloride segment dominated the market with the largest revenue share of 56.0% in 2024.

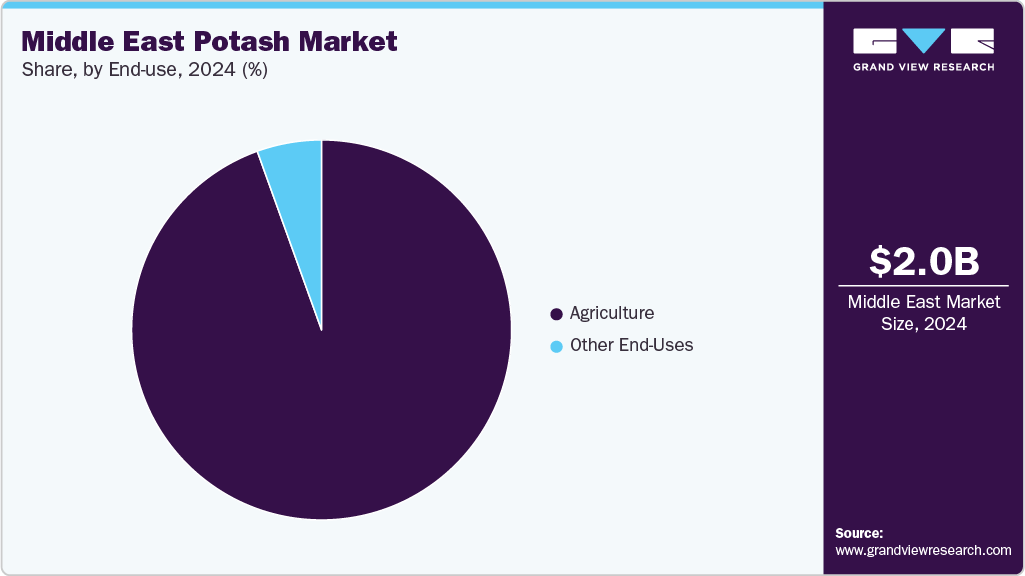

- By end use, the agriculture segment captured the largest revenue share of 94.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2,020.7 Million

- 2033 Projected Market Size: USD 2,892.2 Million

- CAGR (2025-2033): 4.2%

Government-led food security initiatives and subsidies for controlled-environment agriculture, particularly in GCC nations, are accelerating the shift toward high-value horticultural crops that demand low-chloride potash variants such as potassium sulphate and potassium nitrate. Additionally, rising investments in greenhouse and hydroponic farming are boosting demand for water-soluble and specialty potash fertilizers. Significant opportunities exist in the expansion of specialty potash products tailored to chloride-sensitive crops and premium segments such as fruits, vegetables, and greenhouse cultivation. The growing focus on sustainable agriculture practices, including efficient nutrient management and improved crop quality, opens avenues for suppliers offering water-soluble, high-purity potash grades. Furthermore, increasing regional blending and formulation facilities create potential for strategic partnerships and localized production, reducing dependency on imports and enhancing supply chain resilience.

The Middle East potash industry faces challenges from volatile global potash prices and high transportation costs, which directly impact prices in the Middle East. Limited domestic production capacity outside of select brine-based operations constrains supply security, making the region heavily reliant on imports for key products. Moreover, the widespread presence of chloride-sensitive crops restricts the use of cost-effective potassium chloride, necessitating the adoption of more expensive alternatives, which can strain farmer margins without consistent subsidy support. Regulatory variations across countries also pose hurdles for market entry and product registration.

Market Concentration & Characteristics

The Middle East potash market is moderately fragmented. The market is shaped by a mix of regional producers and global suppliers, with key players including Arab Potash Company (Jordan), Israel Chemicals Ltd. (ICL), Uralkali, Nutrien Ltd., and K+S AG. Arab Potash Company leverages its strategic access to the Dead Sea resources, serving as a major supplier of potassium chloride and specialty potash to both domestic and export markets. ICL focuses on diversified potash offerings, including potassium chloride, potassium nitrate, and potassium sulphate, with strong distribution networks across GCC countries. Global leaders such as Uralkali and Nutrien cater to the region through established trading partnerships and bulk supply agreements, ensuring stable access to commodity-grade potash. K+S AG strengthens its presence through its broad product portfolio, including specialty potash grades suitable for chloride-sensitive crops, aligning with the region’s high-value agriculture needs.

To enhance their market position, these companies are adopting strategies such as portfolio diversification toward specialty and water-soluble grades, strategic partnerships with regional distributors, and investment in agronomic advisory services. Many players are expanding their value-added services, including fertigation solutions and crop-specific nutrient programs, to support the growing protected cultivation and greenhouse farming segment in the GCC. Furthermore, partnerships with local blending and formulation facilities enable faster delivery, customized product offerings, and reduced logistics costs. Continuous engagement with government food security initiatives and subsidy programs also serves as a key lever for market penetration and long-term growth.

Product Insights

Potassium Chloride (KCl) held the largest revenue share of 56.0% in 2024 due to its cost-effectiveness, widespread availability, and suitability for a broad range of crops, particularly those that are chloride-tolerant, such as cereals, fodder, and certain cash crops prevalent in the Middle East. Its robust global supply chain, anchored by leading producers and supported by large-scale bulk imports, ensures consistent availability at competitive prices compared to specialty potash variants. Furthermore, its compatibility with conventional fertilization practices and integration into NPK blends make it the most widely used form of potash, especially in open-field farming across the region. While certain high-value horticultural segments demand chloride-free alternatives, the sheer scale of traditional agriculture and field crop acreage continues to favor Potassium Chloride as the dominant product.

Other potash products, including Potassium Sulphate (SOP), Potassium Nitrate (NOP), and specialty formulations, are experiencing faster value growth, driven by the rising adoption of protected cultivation, fertigation, and greenhouse farming. SOP is preferred for chloride-sensitive crops like fruits, vegetables, nuts, and potatoes due to its dual nutrient benefit (potassium and sulfur) and low chloride content. At the same time, NOP caters to niche high-value segments requiring water-soluble, high-purity fertilizers for hydroponics and precision agriculture. Specialty products such as potassium thiosulfate and potassium magnesium sulfate are gaining traction in targeted soil correction and premium crop nutrition programs. Although their current market share remains smaller than KCl, their penetration is expected to rise as the region continues to diversify its agricultural portfolio toward high-value, export-oriented crops.

End-use Insights

The agriculture segment dominated the Middle East potash market with a 94.5% revenue share in 2024, primarily due to the region’s increasing focus on enhancing crop yields, improving soil fertility, and supporting food security initiatives. Potash is a vital macronutrient in agriculture, particularly for boosting crop quality, water retention, and resistance to stress conditions common in arid and saline Middle Eastern soils. The expansion of protected cultivation, greenhouse farming, and high-value horticulture, supported by government subsidies and food self-sufficiency programs, especially in GCC countries, has significantly increased potash consumption. Potassium Chloride remains dominant in large-scale field applications, while chloride-free variants such as Potassium Sulphate and Potassium Nitrate are increasingly adopted for fruits, vegetables, and export-oriented crops.

The other end uses segment in the Middle East potash industry, though accounting for a smaller market share, represents a steady and niche area of demand across industrial and commercial applications. Potash is used in the production of glass and ceramics, pharmaceuticals, water treatment chemicals, and certain explosives, where specific grades and purities are required. This segment benefits from consistent industrial activity but is less price-sensitive compared to agriculture due to its relatively lower consumption volume. With the growth of regional industrial projects and the diversification of economies in the Middle East, non-agricultural applications of potash are expected to witness stable demand. However, they are unlikely to surpass agriculture in market dominance in the foreseeable future.

Regional Insights

The Middle East potash market is witnessing steady growth driven by the region’s strategic focus on enhancing agricultural productivity amid challenging climatic conditions characterized by water scarcity and soil salinity. Countries across the Gulf Cooperation Council (GCC) and Levant are increasingly adopting advanced fertigation techniques, protected cultivation, and greenhouse farming, which are fueling demand for both commodity-grade potassium chloride and premium low-chloride variants such as potassium sulphate and potassium nitrate. Government-led food security programs, coupled with rising investments in high-value horticulture and export-oriented crops, are creating a robust demand base for potash fertilizers. Additionally, the presence of regional producers, particularly in Jordan, alongside imports from global suppliers, ensures a balanced supply chain supporting diverse agricultural practices.

Saudi Arabia represents one of the most significant markets for potash in the Middle East, underpinned by its ambitious food security agenda and Vision 2030 initiatives aimed at achieving greater self-sufficiency in food production. The Kingdom is witnessing a rapid expansion of greenhouse farming, hydroponics, and high-value crop cultivation. This is driving strong demand for specialty potash grades, particularly potassium sulphate and potassium nitrate, due to their suitability for chloride-sensitive crops. Substantial government subsidies, technological adoption in irrigation systems, and partnerships with international fertilizer producers are further accelerating market growth. Saudi Arabia also serves as a key distribution hub within the region, attracting both regional suppliers and global players seeking to strengthen their footprint in the Middle Eastern potash market.

Key Middle East Potash Company Insights

Some of the key players operating in the Middle East Potash market include arabpotash, ICL, Uralkali, Nutrien, K+S Aktiengesellschaft, Mosaic, BHP, Jordan Phosphate Mines Co., and PLC.

- arabpotash (APC), headquartered in Jordan, is a leading producer and exporter of potash in the Middle East, leveraging its strategic access to the mineral-rich Dead Sea. The company specializes in the production of standard, fine, and granular potassium chloride, catering to both agricultural and industrial markets across the region and internationally. APC plays a pivotal role in meeting the growing demand for potash fertilizers in the GCC and Levant, supported by a robust logistics and export infrastructure. Its strategic initiatives focus on expanding production capacity, enhancing operational efficiency, and diversifying into value-added specialty potash products to serve chloride-sensitive crop segments. Through long-term supply agreements, partnerships with regional distributors, and alignment with food security programs, Arab Potash Company continues to strengthen its market position and contribute significantly to the regional fertilizer value chain.

Key Middle East Potash Companies:

- arabpotash

- ICL

- Uralkali

- Nutrien

- K+S Aktiengesellschaft

- Mosaic

- BHP

- Jordan Phosphate Mines Co. PLC

- Intrepid Potash

- Encanto Potash Corp. (EPC)

Middle East Potash Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2,082.2 million

Revenue forecast in 2033

USD 2,892.2 million

Growth rate

CAGR of 4.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, volume in kilotons and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, country

Country scope

Oman; Kuwait; Saudi Arabia; UAE; Qatar; Bahrain; Isael; Rest of Middle East

Key companies profiled

arabpotash; ICL; Uralkali; Nutrien; K+S Aktiengesellschaft; Mosaic; BHP; Jordan Phosphate Mines Co. PLC; Intrepid Potash; Encanto Potash Corp. (EPC)

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Potash Market Report Segmentation

This report forecasts volume & revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the Middle East potash market report based on product, end-use, and country:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Potassium Chloride

-

Potassium Sulphate

-

Potassium Nitrate

-

Other Products

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Agriculture

-

Other End-Uses

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Oman

-

Kuwait

-

Saudi Arabia

-

UAE

-

Qatar

-

Bahrain

-

Israel

-

Rest of Middle East

-

Frequently Asked Questions About This Report

b. The Middle East potash market size was estimated at USD 2,020.7 million in 2024 and is expected to reach USD 2,082.2 million in 2025.

b. The Middle East potash market is expected to grow at a compound annual growth rate of 4.2% from 2025 to 2033 to reach USD 2,892.2 million by 2033.

b. The agriculture segment dominated the market in 2024 due to its extensive use of potash fertilizers for enhancing crop yields, improving soil fertility, and supporting government-driven food security initiatives across the Middle East. Rising adoption of protected cultivation and high-value horticulture further accelerated potash consumption in this segment.

b. Some of the key players operating in the Middle East Potash market include arabpotash, ICL, Uralkali, Nutrien, K+S Aktiengesellschaft, Mosaic, BHP, Jordan Phosphate Mines Co. PLC, Intrepid Potash, and Encanto Potash Corp. (EPC).

b. The Middle East potash market is driven by growing demand for high-value crops, increased adoption of precision agriculture and fertigation techniques, and government-backed food security initiatives promoting efficient nutrient management in arid and saline soil conditions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.