Wondering how to buy crypto but not sure where to start? Our beginner's guide explains how and where to invest in digital assets l...

Our top picks include Bitcoin Hyper for Bitcoin scalability, Maxi Doge for meme coin exposure, and Pump.fun for its dominant launchpad position.

We also covered some more popular names like Kaspa and Render Network alongside newer presale opportunities.

We researched over 100 cryptocurrencies across every sector to find the ones with genuine breakout potential for 2026, narrowing it down to the 11 most likely candidates. Today, we’ll break down these coins individually, explain what makes a crypto explode, and show you how to spot high-potential coins yourself.

Cryptocurrencies to Explode in 2026 – Key Takeaways

- Crypto explosions happen when strong fundamentals meet good market timing and the right narrative at the same time.

- Possible 2026 catalysts include: the next Bitcoin halving effects kicking in, the launch of new ETF products, a surge in Solana activity, and major Layer 2 upgrades.

- The biggest gains come from presales and early listings, but these are also the projects most likely to go to zero.

- You’ll find these projects early on Crypto Twitter, Telegram groups, and sites like CoinSniper before they hit Coinbase or Binance.

- Bitcoin Hyper, Maxi Doge, and PEPENODE give you the best shot at early entry before major exchange listings.

Editor’s Picks – Top Cryptocurrencies That Could Explode Next

- First Bitcoin Layer 2 enabling fast, low-cost transactions

- Fixes Bitcoin’s speed and fee limitations with near real-time performance

- Enables a Bitcoin-native DeFi ecosystem

- Degen meme coin inspired by max-leverage trading

- A tribute to high-risk hustle — fueled by sweat and conviction

- Ethereum-born, culture-driven, aiming for multichain

- Build your own virtual meme coin mining rig.

- 100% virtual and requires no additional computing power.

- Top miners get additional bonuses in Pepe, Fartcoin, and other meme coins.

- Shared liquidity spanning Bitcoin, Ethereum, and Solana

- Improved trade execution through faster speeds and secure cross-chain capital movement

- Opens up greater cross-ecosystem connectivity for builders and developers

- Quantum-resistant security infrastructure for wallets and enterprise use

- Uses deflationary tokenonomics, including burns, tied to quantum workload execution

- Staking and governance participation expand token utility

- AI-Powered Virtual Influencers

- 20% APY Staking Rewards

- VIP perks: livestreams, BTS content, credits, and more.

- Connecting DeFi and TradFi in a singular exchange

- BFX holders earn USDT from platform trading activity

- Access to over 500 tradable assets, including commodities

- High-performance broker for pros and newcomers alike

- Rebates and buybacks come from VFX's own market activity

- 10% bonus on sign up and early staking access

List of Crypto that Could Explode in 2026

- Bitcoin Hyper (HYPER): Reduced transaction fees on Bitcoin via Layer-2.

- Maxi Doge (MAXI): Meme coin with high staking and leveraged trading.

- Pump.fun (PUMP): Solana meme coin launchpad with revenue sharing.

- PEPENODE (PEPENODE): Gamified mine-to-earn meme coin.

- Brett (BRETT): Large-community Base network meme coin.

- LiquidChain (LIQUID): Unifying multi-chain liquidity into one execution layer.

- SUBBD (SUBBD): AI-powered content creation platform.

- Kaspa (KAS): Fast, scalable proof-of-work network.

- Render Network (RENDER): Decentralized GPU rendering services.

- Hyperliquid (HYPE): Gas-free Layer-1 DEX for institutional trading.

10 Crypto Projects That Could Explode in 2026

We’ve analyzed hundreds of different cryptos to see which ones have explosive potential. Here’s what we found:

1. Bitcoin Hyper (HYPER)

Bitcoin Hyper is a Layer-2 solution built on top of the Bitcoin blockchain that uses the Solana Virtual Machine to process transactions faster and cheaper than the Bitcoin mainnet. The project uses a Canonical Bridge system where users deposit BTC to a monitored Bitcoin address, the Bitcoin Relay Program verifies the transaction through smart contracts, and an equivalent amount of wrapped BTC gets minted on the Layer-2 network.

Bitcoin Hyper’s branding features and official logo. Source: Bitcoin Hyper

Why HYPER could be the next crypto to explode: HYPER aims to bring faster and cheaper transactions to Bitcoin without compromising its security, bridging the liquidity of Bitcoin with modern smart contract functionality. If the project proves reliable and efficient, it could attract developers and users looking for scalable Bitcoin-based applications.

Bitcoin Hyper Quick Facts

| Project + Ticker | Bitcoin Hyper (HYPER) |

| Chain | Bitcoin Layer-2 (Solana Virtual Machine) |

| Status | In presale |

| Price | $0.013445 |

| Funds Raised | $29.6M |

| Time Until Next Price Update | Loading...

|

| Max Token Supply | 21 billion HYPER |

| Community Size | 4.5K+ Telegram / 14K+ X |

| Audit Status | Audited by Coinsult and SpyWolf |

| Potential to explode | 🔥🔥🔥🔥 (4/5) – addresses Bitcoin’s scalability issues with proven SVM technology |

2. Maxi Doge (MAXI)

Imagine a meme coin that wears gym shorts (that’s what Maxi Doge is going for). Launched in July 2025, Maxi Doge is an Ethereum-based token that started its presale at around $0.00025 per token.

Behind its silly branding lies a plan. The developers want to mix the hype of meme coins with features that will keep the fans engaged. This means futures integration, trading tournaments, and high-yield staking.

As of now, the project has accumulated around $4 million in investments, which suggests serious interest in Maxi Doge. Early supporters are being offered generous staking yields, which should encourage holding rather than an immediate dump after launch.

Maxi Doge’s branding features a muscular doge mascot in a trading environment. Source: Maxi Doge

Why it could explode: Because the presale price is tiny and the supply is massive, even a modest growth post-listing could lead to big gains for early buyers. On top of that, the combination of staking, community competitions, and planned futures trading gives Maxi Doge a deeper structure than most meme coins that simply offer fun.

Maxi Doge Quick Facts

| Project + Ticker | Maxi Doge (MAXI) |

| Chain | Ethereum (ERC-20) |

| Status | In presale |

| Price | $0.000274 |

| Funds Raised | $4.35M |

| Time Until Next Price Update | Loading...

|

| Max Supply | 150.24 billion MAXI |

| Community Size | 4.2K+ X followers, 2.4K+ Telegram members |

| Audit Status | Audited by SolidProof and Coinsult |

| Potential to explode | 🔥🔥🔥 (3/5) – solid meme play with strong presale momentum and high staking rewards |

3. Pump.fun (PUMP)

Pump.fun is a Solana-based token launchpad that launched in January 2024 and allows users to create and trade tokens instantly without technical knowledge or upfront liquidity. The platform uses an automated system to handle pricing, and tokens that reach certain market cap thresholds can “graduate” to decentralized exchanges like Raydium. The token serves as the official utility token for the pump.fun platform and swap.pump.fun AMM protocol, though it’s not required to use the platform.

Why PUMP could be the next crypto to explode: PUMP could see rapid growth because its native platform lowers the entry barrier for new projects on Solana. Its bonding curve model encourages continuous liquidity and price discovery, which can drive high trading activity. As the platform expands and its token gains more utility across related protocols, overall ecosystem demand could increase.

Pump.fun Quick Facts

| Project + Ticker | Pump.fun (PUMP) |

| Chain | Solana (SOL) |

| Status | Live |

| Price | $0.006 |

| Funds Raised | $1.3 billion |

| Max Supply | 1 trillion PUMP |

| Community Size | 100,800+ holders, over 12.8 million tokens created on platform |

| Audit Status | Not specified |

| Potential to explode | 🔥🔥🔥🔥 (4/5) – dominant token launchpad with massive revenue and proven platform utility |

4. PEPENODE (PEPENODE)

PEPENODE’s mine-to-earn model allows holders to purchase virtual Miner Nodes with PEPENODE tokens, combine them to create mining setups, and earn both PEPENODE and established meme coins like Pepe and Fartcoin. The project implements deflationary tokenomics where 70% of tokens spent on node purchases and upgrades get burned permanently.

Caption: PepeNode markets itself as the world’s first mine-to-earn memecoin. Source: PepeNode

Why PEPENODE could be the next crypto to explode: PEPENODE offers gamified ways for users to earn rewards. Its deflationary mechanics, which burn a large portion of tokens during gameplay, may create scarcity and drive interest. If the project successfully delivers cross-chain expansion and listings, it could attract both gamers and meme coin traders seeking engagement and utility.

PEPENODE Quick Facts

| Project + Ticker | PEPENODE (PEPENODE) |

| Chain | Ethereum (ERC-20) |

| Status | In presale |

| Price | $0.0012016 |

| Funds Raised | $2.37M |

| Time Until Next Price Update | Loading...

|

| Max Supply | 420 billion PEPENODE |

| Community Size | 4K+ X followers, 3.2K+ Telegram members |

| Audit Status | Audited by Coinsult |

| Potential to explode | 🔥🔥🔥 (3/5) – unique gamified mining concept with deflationary mechanics and high staking rewards |

5. Brett (BRETT)

Brett is a meme coin that launched on the Base blockchain, as an Ethereum Layer 2 scaling solution developed by Coinbase. The token draws inspiration from Brett, a character from Matt Furie’s Boy’s Club comic series that also features Pepe the Frog. The project launched with no presale, a renounced contract, and 85% of tokens added directly to liquidity, with zero transaction taxes.

Why BRETT could be the next crypto to explode: Brett’s fair launch structure and tax-free transactions have built trust among traders and reduced barriers to entry. If market sentiment toward meme coins strengthens or Base network adoption increases, Brett could benefit from increased visibility and liquidity.

Brett Quick Facts

| Project + Ticker | Brett (BRETT) |

| Chain | Base (Ethereum Layer 2) |

| Status | Live |

| Price | $0.044 |

| Funds Raised | N/A – fair launch |

| Max Supply | 10 billion BRETT |

| Community Size | 871,000+ holders |

| Audit Status | Renounced contract |

| Potential to explode | 🔥🔥🔥 (3/5) – established Base chain mascot with strong community and proven track record |

6. LiquidChain (LIQUID)

LiquidChain is a new Layer 3 blockchain designed to unify liquidity across Bitcoin, Ethereum, and Solana. The idea is to connect them into one place instead of leaving their liquidity stuck in separate ecosystems. It uses unified liquidity pools, a fast Solana-style VM, and cross-chain proofs so assets from all three chains can interact without the usual bridging delays or risk.

LiquidChain presale accepts crypto payments via wallet connection or credit card purchases with optional staking. Source: LiquidChain

Why LiquidChain could explode: The project is trying to solve real issues that traders and developers deal with every day: slow bridging, fragmented markets, and redundant development. If the technology works as described, it could make cross-chain trading smoother and give DeFi apps immediate access to BTC, ETH, and SOL liquidity.

LiquidChain Quick Facts

| Project + Ticker | LiquidChain (LIQUID) |

| Chain | Layer 3 |

| Status | Active presale (stage 13) |

| Funds Raised | $150.446/$438,966 |

| Max Supply | 11,800,000,100 $LIQUID |

| Audit Status | Trust and safety audits mentioned on the website (Spywolf and CertiK) |

| Potential to explode | 🔥🔥🔥 (3/5) – aims to remove bridging friction and offer a high performance VM for cross-chain DeFi |

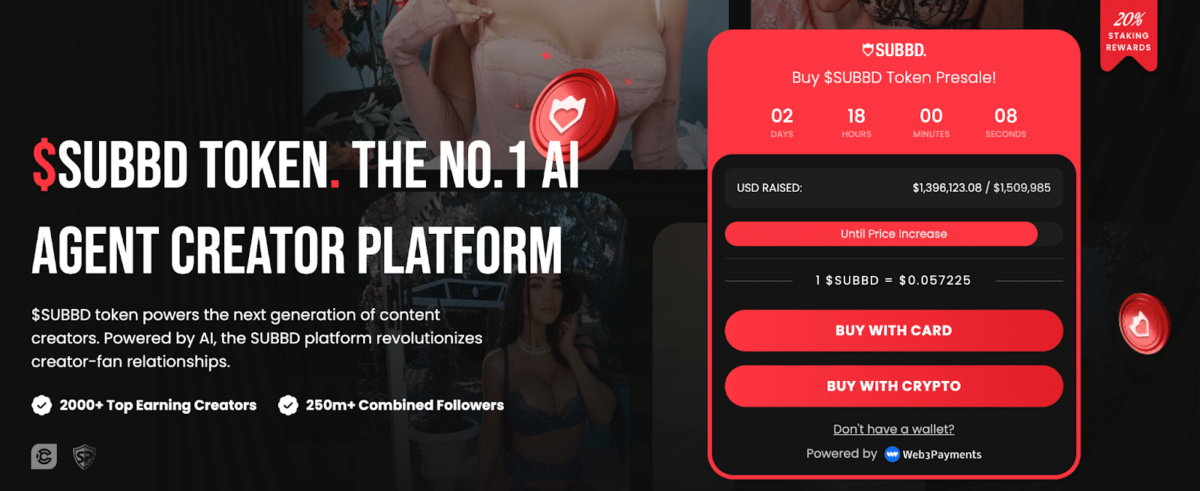

7. SUBBD (SUBBD)

SUBBD is a mash-up between a subscription site and a tech startup, with the creators in the driver’s seat. SUBBD is building an AI-powered, tokenized platform that aims to give creators back control over their content and income. The project targets a major industry (subscription), where platforms like OnlyFans generated $5.6 billion in 2023.

SUBBD promises to make the “admin side” of being a creator disappear altogether. Source: SUBBD

At its core, SUBBD promises to make the “admin side” of being a creator disappear altogether. Instead of juggling DMs, editing, content tagging, and scheduling manually or by using multiple apps, creators get AI tools in a single platform. They can lock certain content behind subscriptions or pay-per-view, charging fans directly for premium access. Features like chat packages, video calls, and livestreams help creators and fans connect more personally, and they can also be monetized.

Why it could explode: The subscription content /creator economy is huge. SUBBD’s pitch is that it could change the industry by offering modern tools and crypto-native monetization. The platform claims to already have thousands of creators on board, collectively reaching hundreds of millions of followers. If this is true, that’s a sign there is real demand, not just hype.

SUBBD Quick Facts

| Project + Ticker | SUBBD (SUBBD) |

| Chain | Ethereum (ERC-20) |

| Status | In presale |

| Price | $0.057225 |

| Funds Raised | $1.4M |

| Time Until Next Price Update | Loading...

|

| Max Supply | 1 billion SUBBD |

| Community Size | 250+ million followers through 2,000+ creator partnerships |

| Audit Status | Not specified |

| Potential to explode | 🔥🔥🔥 (3/5) – targets massive creator economy with AI tools but newer project with less track record |

8. Kaspa (KAS)

Kaspa is a proof-of-work Layer-1 blockchain that uses the GHOSTDAG protocol to process blocks in parallel rather than sequentially. The project launched in November 2021 with a fair launch model with no pre-mine, no presale, and no central governance. It currently processes 10 blocks per second with plans to scale to 100 BPS, offering transaction confirmations in about 10 seconds, limited only by internet latency.

Why KASPA could be the next crypto to explode: Kaspa could gain momentum for enabling high-speed parallel block processing while maintaining proof-of-work security. As the network scales toward 100 blocks per second, its speed and efficiency could position it as a leading alternative to traditional Layer-1 blockchains.

Kaspa Quick Facts

| Project + Ticker | Kaspa (KAS) |

| Chain | Kaspa (Layer-1 BlockDAG) |

| Status | Live |

| Price | $0.075 |

| Funds Raised | N/A – fair launch |

| Max Supply | 28.7 billion KAS |

| Community Size | 7,900+ holders |

| Audit Status | Open-source, no central governance |

| Potential to explode | 🔥🔥🔥 (3/5) – proven BlockDAG technology with strong fundamentals but already established with $2B market cap |

9. Render Network (RENDER)

Render Network is a decentralized GPU computing platform that connects idle GPU power from node operators with creators who need processing power for 3D rendering, AI applications, and machine learning. Render has partnerships with major entertainment companies and counts industry leaders like Ari Emanuel, JJ Abrams, Brendan Eich, and digital artist Beeple on its advisory board.

Why RENDER could be the next crypto to explode: As demand for decentralized GPU power rises across AI, 3D rendering, and machine learning industries, Render could find itself in very high demand. Its real-world utility, backed by OTOY’s established technology and partnerships with major entertainment and tech figures, strengthens its credibility.

Render Quick Facts

| Project + Ticker | Render Network (RENDER) |

| Chain | Solana (migrated from Ethereum) |

| Status | Live |

| Price | $3.40 |

| Max Supply | 644 million RENDER |

| Community Size | 110,000K+ holders |

| Audit Status | Governed by Render Network Foundation |

| Potential to explode | 🔥🔥🔥🔥 (4/5) – established DePIN leader with real utility in growing AI and 3D rendering markets |

10. Hyperliquid (HYPE)

Hyperliquid is a decentralized perpetual futures exchange built on its own custom Layer-1 blockchain. The platform launched its mainnet in March 2024 and processes approximately 100,000 transactions per second with block latency under one second. Hyperliquid features a fully on-chain order book, zero gas fees for trading, and supports leverage up to 50x on perpetual contracts. The platform has exceeded $4 billion in daily trading volume and serves over 300,000 users.

Why it could explode: Hyperliquid’s growing user base and $4 billion daily trading volume indicate strong market adoption in the DeFi derivatives sector. With an experienced team from top universities and trading firms, the platform’s credibility and technical expertise may further drive trust and usage.

Hyperliquid Quick Facts

| Project + Ticker | Hyperliquid (HYPE) |

| Chain | Hyperliquid L1 (Custom Layer-1) |

| Status | Live |

| Price | $46 |

| Max Supply | 1 billion HYPE |

| Community Size | 300,000+ users, $4+ billion daily trading volume |

| Audit Status | Audited by Zellic |

| Potential to explode | 🔥🔥🔥🔥🔥 (5/5) – dominant perps DEX with proven product-market fit, massive trading volumes, and strong community-first approach with no VC influence |

Comparing the Most Likely Crypto Tokens to Explode

| Coin | Primary Function | Network / Platform | Potential to Explode |

| Bitcoin Hyper (HYPER) | Layer-2 scaling | Bitcoin | High, if Bitcoin adoption and Layer-2 demand grows |

| Maxi Doge (MAXI) | Meme coin / staking | Ethereum / unspecified | Medium–High, fueled by hype and staking rewards |

| Pump.fun (PUMP) | Meme coin launchpad | Solana | High, tied to Solana’s token launches and revenue share |

| PEPENODE (PEPENODE) | Gamified token | Ethereum / unspecified | Medium, driven by gamification and mine-to-earn appeal |

| Brett (BRETT) | Meme coin | Base | Medium, large community provides social momentum |

| LiquidChain (Liquid) | Layer 3 Architecture | Independent Layer 3 chain | Moderate to high – focuses on real issues like slow bridging and fragmented liquidity |

| SUBBD (SUBBD) | AI content platform | Ethereum / unspecified | High, AI content tools are trending and monetizable |

| Kaspa (KAS) | Proof-of-work / scalable DAG | Kaspa | Medium, scalability adoption may increase demand |

| Render Network (RENDER) | Decentralized GPU computing | Ethereum | High, demand for decentralized rendering grows |

| Hyperliquid (HYPE) | L1 DEX | Hyperliquid L1 | High, zero-gas trading and institutional use could drive growth |

What Does It Mean When a Crypto Explodes?

A crypto “explodes” when its price shoots up fast, sometimes 10x, 100x, or more in just weeks or months.

This happens when strong project fundamentals, perfect market timing, and active community support all line up to create buying pressure in the crypto market that exceeds the tokens available to buy.

Why Do Certain Crypto Coins “Explode”?

Price explosions rarely happen by accident. They start with a catalyst, maybe a major exchange listing, a product launch that functions well, a partnership announcement that opens new markets, or a shift in regulations that suddenly makes a project viable.

The projects that skyrocket combine this catalyst with infrastructure already in place. It could be working technology, an active user base, and tokenomics that reward holders rather than dump on them.

The second factor is timing within the broader market cycle. Even excellent projects stagnate during bear markets when capital flows out of crypto entirely.

The projects that explode are the ones positioned correctly when liquidity returns to the market. They’ve built during the quiet periods and launch or gain traction just as new money enters the space.

Factors Driving the Next Crypto to Explode

If you want to find crypto that could explode, you’ll need to know the telltale signs and factors that all promising projects exhibit. Here are some of the most important ones:

Community, Hype, and Network Effect

A strong community uses it, builds on it, and brings new users in. Projects with active Discord servers, engaged Twitter followers, and developers who ship code create momentum that feeds on itself. When you see whale wallets accumulate tokens and influencers cover a project without being paid, that’s a sign the network effect has started.

Hype backed by genuine utility can carry a token through multiple market cycles. The crypto projects that go to 1000x are the ones where early adopters become evangelists because the product solved a real problem for them. Each new user makes the network more valuable for everyone else, which attracts more users, and in turn, more capital.

Market Conditions

The best project in the world goes nowhere during a bear market when capital flows out of crypto entirely. Bull markets lift most boats, but the projects that explode are the ones that are well-positioned when liquidity returns.. Bitcoin’s price action sets the tone for the entire market, and altcoins typically follow with amplified moves in both directions.

Timing matters more than most people admit. A mediocre project launched during peak euphoria can outperform an excellent project launched during a market downturn. The projects that time their token generation events, exchange listings, and major announcements to coincide with favorable market conditions get way more attention and money than their fundamentals alone would justify.

Partnerships and Integrations

Real partnerships open new markets and user bases that projects can’t reach alone. When a DeFi protocol integrates with a major wallet or an infrastructure project signs a deal with enterprise clients, those deals provide distribution channels.

Integration with established platforms provides immediate credibility and access to existing liquidity. A project that gets added to Coinbase, integrated into MetaMask, or adopted by a popular dApp inherits trust and attention that would take years to build independently.

Scarcity and Tokenomics

Supply mechanics control whether your gains multiply or get diluted away. When only 20% of the total supply is in circulation and the rest vests over the years, each new buyer competes for a limited pool of tokens, which pushes prices higher than projects where founders can dump millions whenever they want.

Projects that lock team tokens with multi-year vesting, allocate reasonable percentages to community rewards, and use buyback mechanisms to remove tokens from circulation align everyone’s incentives. On the other hand, if you see that the project allocated 40% to the team, you can be sure that they’ll dump on you when prices jump.

Narrative Timing

The market cycles through themes, and projects that match the current theme get way more attention than everything else. When AI was hot, AI tokens pumped regardless of whether they did anything useful. When everyone talked about real-world assets, RWA projects exploded.

The projects that time their launch or major updates to match whatever story dominates crypto Twitter tend to outperform better projects with worse timing. You’re not trying to create hype from scratch when you can ride hype that already exists.

Three High Potential Coins That Didn’t Make the Cut

Let’s briefly touch on some additional projects that came close to but didn’t quite make our top picks:

1. Polkadot (DOT)

Polkadot is a Layer-0 blockchain platform that Ethereum co-founder Dr. Gavin Wood launched in 2020 to connect different blockchains so they can communicate seamlessly. The network uses a central Relay Chain for security while specialized blockchains called parachains plug into it and transfer data across chains.

Why It Didn’t Make Our Toplist:

The auction system required projects to lock up millions in DOT for two years. By June 2022, auction values crashed from $1.3 billion to just $55,000 as interest disappeared. Polkadot also abandoned parachains entirely with its 2.0 upgrade, and a fundamental architecture overhaul just years after launch raises serious questions about execution.

2. Tron (TRX)

Tron is a decentralized blockchain platform that Justin Sun launched in 2017 to let content creators monetize their work directly without relying on middlemen like YouTube or Spotify taking massive cuts. The platform acquired BitTorrent in 2018 for $140 million to expand its decentralized file sharing capabilities and has since built a substantial DeFi ecosystem.

Why It Didn’t Make Our Toplist:

Only 27 Super Representatives control the entire network, and Justin Sun’s influence over Tron raises questions about true decentralization. The platform operates more like a corporate entity than a community-driven blockchain. Additionally, Tron faced widespread criticism for copying large portions of its whitepaper from other projects including Ethereum and Filecoin without proper attribution.

3. Monero (XMR)

Monero is a privacy-focused cryptocurrency launched in 2014 that uses advanced cryptography to make transactions completely confidential and untraceable. Unlike Bitcoin where anyone can see wallet balances and transaction histories on the public blockchain, Monero hides the sender, receiver, and transaction amount using technologies like ring signatures and stealth addresses.

Why It Didn’t Make Our Toplist:

Exchanges across Europe, South Korea, Japan, and Australia have delisted Monero due to government pressure over money laundering concerns, making it difficult for average investors to buy and sell. Monero’s association with darknet markets and illicit activities created a permanent stigma that prevented institutional investment and widespread acceptance.

How to Buy High-Growth Potential Crypto Step-by-Step

Most of the cryptocurrencies we covered today aren’t trading on big exchanges yet. They are either in presale or only available through smaller, decentralized exchange platforms. This means that you won’t be able to scoop them up on places like Coinbase just yet. Your option is to use a presale site directly or a DEX where applicable.

Here is the simplest way to do that:

- Set Up a Compatible Wallet: You will need a non-custodial wallet (which means you control the keys) to buy any early-stage token. Apps like BestWallet, MetaMask, and Trust Wallet all work well because they support multiple blockchains and connect easily to presale websites.

- Buy Cryptocurrency to Fund Your Purchase: Most presales accept ETH, USDT, BNB, or other major cryptocurrencies. Buy one of these on any exchange like Coinbase, Binance, or Kraken. Transfer the crypto from the exchange to your wallet address. Make sure you’re on the correct network when you transfer or you’ll lose your funds.

- Connect to the Presale Website: Go to the official presale website for the project you want to buy. Always verify the URL through the project’s official Twitter or Telegram to avoid scam sites. Click the “Connect Wallet” button and select your wallet from the options. Approve the connection request in your wallet.

- Select Your Purchase Amount: Enter how much you want to invest or how many tokens you want to buy. The presale site will show you how much ETH, BNB, or USDT you need. Review the details carefully, including any bonus tokens or vesting schedules. Click “Buy Now” or similar button to proceed.

- Confirm the Transaction: A transaction request will appear in your wallet. Review the gas fees and total cost. Approve the transaction in your wallet. Wait for the blockchain to confirm your purchase, which typically takes 30 seconds to a few minutes depending on network congestion.

- Claim Your Tokens: Some presales send tokens immediately, while others require you to claim them after the presale ends. Check the project’s documentation for claim instructions. Return to the presale website after the Token Generation Event, connect your wallet, and click “Claim” to receive your tokens.

For Exchange-Listed Tokens

If you’re buying a token already listed on exchanges, the process is simpler. Create an account on an exchange that lists the token, complete KYC verification if required, deposit funds, and buy the token directly through the exchange’s trading interface.

You can leave tokens on the exchange or withdraw them to your personal wallet for better security.

Where to Find the Next Crypto to Boom?

The next big crypto project won’t advertise itself on mainstream platforms after it already exploded. You need to look in specific places where early-stage projects build their communities and announce launches before the wider market catches on.

Here are the platforms and methods that we’ve used to find these promising cryptos that we covered today:

Crypto Twitter (X)

Follow accounts that cover new coin launches, presales, and emerging trends. The best accounts share projects weeks or months before they hit major exchanges.

Look for analysts who do deep dives into tokenomics and team backgrounds and not just post paid promo content. When you see multiple respected accounts mention the same project independently, that might be worth taking a closer look.

Crypto Telegram Groups

If you like hearing about projects before they hit the mainstream, Telegram is the place where most of the noise starts. We are talking launchpads, presale hubs, and niche sectors like DeFi, gaming tokens, or meme coins. These all run announcement channels that drop every detail about new launches and presales.

Just keep your guard up. Telegram is useful, but it can also be a magnet for scammers. Stick to the official channels and look for verified badges. Don’t open random links someone DMs you.

Presale Aggregator Websites

If you prefer a more organized approach, presale aggregator websites are also worth checking. Platforms like CoinSniper, CryptoRank, and ICO Drops list upcoming presales, as well as helpful information about tokenomics, audits, etc.

These websites will let you sort by categories like blockchain, theme, or release date. That’s very useful since you can quickly find projects that fit your style.

Discord Communities

Active Discord servers for specific crypto sectors host discussions where experienced investors share projects they’re researching.

Servers focused on DeFi, NFTs, or specific chains like Solana or Base often surface local projects before they explode. Ask questions and share your own research to build connections with serious investors.

Launchpad Platforms

Platforms like Polkastarter, DAO Maker, and TrustSwap vet projects before hosting their token sales.

While you might need to hold their platform tokens to access the best deals, these launchpads filter out obvious scams and provide some due diligence. Projects that launch through established launchpads start with more credibility than random presales.

GitHub and Developer Activity

Check GitHub repositories to see if projects have developers who commit code regularly. Projects with active development and public code tend to be more legitimate than those with no visible technical work. Look for frequent commits, multiple contributors, and detailed documentation as signs the team is building something real.

DeFi and NFT Marketplaces

New tokens often launch liquidity pools on Uniswap, PancakeSwap, or Raydium before exchange listings. Check “new pairs” sections on these DEXs to find tokens in their first hours or days of trading. Similarly, NFT marketplaces like OpenSea and Magic Eden surface new collections that might indicate broader project launches.

Our Methodology – How We Picked the Next Crypto that Could Explode

The research team analyzed a wide range of metrics to answer the question: What is the next crypto to explode? Basing our framework on Coinspeaker’s methodology, we came up with a set of criteria that, when in place, could result in significant gains for a particular coin project.

Utility and Real-World Application (25%)

Crypto utility ranks as our top priority because projects need to solve actual problems to survive long-term. We look for tokens that unlock specific products and services within their ecosystem, like reduced fees or access to higher DeFi yields. Projects that just exist without purpose rarely sustain meaningful growth.

Tokenomics and Supply Structure (20%)

Token economics determine whether a project can maintain healthy price action. We examine total supply limits, distribution models, and token standards like ERC-20 or SPL. Fair distribution prevents crypto whales and insiders from manipulating markets through concentrated holdings.

Development Progress and Roadmap (20%)

Early-stage projects with the biggest gains start as innovative technologies still in development. We track roadmap progress and milestone completion to ensure teams actually build what they promise. Consistent development activity separates serious projects from abandoned experiments.

Market Positioning and Narrative (15%)

Some sectors in crypto heat up faster than others. Projects that tap into the trends often see stronger momentum. Right now, a lot of attention is going into areas like Layer 2 scaling, AI-powered tools, automated trading bots, as well as new DeFi mechanisms. These topics tend to attract developers and investors, giving them stronger market positioning.

Still, even if the narrative is strong, it’s hard to know which tokens inside that category will actually take off. Trends will help narrow the field, but they won’t guarantee winners.

Market Capitalization Potential (10%)

Smaller market-cap tokens naturally have more room to run. It’s the same logic you would use if you compare a young growth stock to a giant blue-chip company. The big names simply don’t have the same explosive upside because they are already massive, right?

Early-stage crypto projects can move quickly if the demand picks up. Of course, this extra upside comes with much higher risk. Still, for many investors, that’s exactly why they pay so much attention to these coins.

Risk Assessment and Due Diligence (10%)

Crypto markets attract scammers who launch projects solely to steal investor funds. Thorough research helps identify red flags before money gets lost. The more due diligence conducted, the better your chances of avoiding obvious traps.

Risks of Trying to Identify the Next Big Cryptocurrency to Explode

Looking for explosive crypto gains means dealing with risks that don’t exist in traditional investments. Here are the most common pitfalls you should be aware of in the crypto world:

- Rug pulls and exit scams: Teams can drain liquidity pools, abandon projects after raising funds, or sell massive token allocations and disappear. Even audited projects with active communities have turned out to be elaborate scams where founders planned the exit from day one.

- Extreme volatility: Presale tokens and new listings can drop 50-90% within hours or days of launch. Price swings that would be catastrophic in traditional markets are normal for early-stage crypto, and most projects never recover from their initial dump.

- Lack of liquidity: You might own tokens worth thousands on paper but can’t sell them without crashing the price by 80%. Low liquidity means you’re trapped in positions even when you want to exit, and large sells can trigger cascading price drops that leave you with pennies.

- Smart contract vulnerabilities: Bugs in the code can lock your funds permanently, allow hackers to drain the treasury, or create unintended consequences that destroy token value. Even professional audits can miss critical flaws in smart contracts that get exploited weeks or months after launch.

- Regulatory uncertainty: Projects can get shut down by regulators, delisted from exchanges, or face legal action that tanks token prices overnight. What’s legal today might be classified as a security tomorrow, leaving token holders with worthless assets and no recourse.

- Team incompetence or abandonment: Founders might have good intentions but lack the skills to execute their roadmap, run out of money before delivering promised features, or simply lose interest and move on to new projects. Most crypto projects fail not because of scams but because teams couldn’t build what they promised.

Conclusion – Which Crypto Is Most Likely to Explode in 2026?

Bitcoin Hyper, Maxi Doge, and Pump.fun look like the best-positioned projects heading into 2026. Bitcoin Hyper tackles Bitcoin’s biggest limitations, while Maxi Doge has real presale momentum behind it. Pump.fun continues to generate massive revenue from its launchpad model.

That being said, the truth doesn’t change here: most crypto projects never take off. For every token that pulls a 50x or 100x, hundreds fail quietly and rapidly. Strong fundamentals and good timing can improve the odds significantly, but nothing guarantees returns in crypto.

If you are looking for the breakout plays in 2026, our tip is to keep your allocations small and spread your risk across multiple projects. You should only invest what you are fully prepared to lose. Crypto can reward early buyers, but it can also punish overconfidence.

Crypto Most Likely to Explode FAQ

Which coins will explode in 2026?

Which crypto has the potential to explode?

How do I find crypto before it explodes?

What makes a cryptocurrency ready to explode?

Which crypto has the biggest growth potential in 2026?

References

- Credit Card Processing Fees – Value Penguin

- Hyperliquid Smart Contract Patch Review – Zellic

- What is GHOSTDAG and DAGKNIGHT – Kaspa

- Bitcoin & Ethereum’s Selling Pressure – Trading View

- Crypto Industry Report – CoinGecko

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

We’ve spent weeks analyzing LivLive’s whitepaper, presale data, and community sentiment to come up with our honest take on where L...

In this article, we examine whether Super Pepe is a legitimate opportunity or a potential scam, highlighting its charity-focused m...

Fact-Checked by:

Fact-Checked by:

30 mins

30 mins

Filip Stojanovic

, 38 postsI’m a crypto content strategist and writer who helps Web3 projects tell their story, build trust, and grow engaged communities in an increasingly competitive space. I’ve worked with presale tokens, exchanges, blockchain startups, and crypto marketing agencies, shaping content strategies that not only explain complex concepts but also inspire confidence, attract investors, and drive adoption.

My experience spans a wide variety of formats, from whitepapers, token launch campaigns, and pitch decks to thought leadership articles, technical documentation, and in-depth guides. Before diving into Web3, I built my expertise in B2B SaaS writing. This structured, analytical approach now underpins my work in crypto, allowing me to bring clarity and credibility to projects in a space often criticized for hype and jargon.

I’m especially interested in how blockchain innovation translates into real-world utility. My recent work explores the evolving role of DeFi protocols, NFT ecosystems, and next-generation infrastructure in reshaping industries and creating new opportunities for both businesses and individuals.