Reeves' pre-Budget speech fails to rule out tax rises

Tax rises could mean reversing a core election manifesto pledge of not raising VAT, National Insurance or income tax

- Published

Chancellor Rachel Reeves has said she will make "necessary choices" in the Budget after the "world has thrown more challenges our way".

In an unusual pre-Budget speech in Downing Street, Reeves did not rule out a U-turn on Labour's general election manifesto pledge not to hike income tax, VAT or National Insurance.

When journalists explicitly asked if the government was set to break that pledge she did not answer directly but said she was "setting the context for the Budget".

Shadow chancellor Sir Mel Stride said the "emergency" speech confirmed "the fears of households and businesses - that tax rises are coming." He added that if Reeves "breaks her promise and hikes taxes again, she must go".

If there was any doubt about tax rises before this speech, there isn't now.

Yet when pressed on which taxes might go up, Reeves refused to go into specifics.

Instead she began the work of explaining why a year after delivering a tax-raising Budget and vowing not to come back for more, she is in fact coming back for more.

The chancellor said she would do what is necessary, not what is popular.

The reasons she gave were poor productivity, for which she blamed Conservative government policy including Brexit, austerity and short-sighted decisions to cut infrastructure spending, persistently high global inflation and the uncertainty unleashed by Donald Trump's tariffs.

In short, Reeves' argument is that the failings of others are being visited upon this government, and that it falls to her to confront decisions her predecessors ducked.

She pledged to come up with a "Budget for growth with fairness at its heart" aimed at bringing down NHS waiting lists, the national debt and the cost of living.

"It is important that people understand the circumstances we are facing, the principles guiding my choices – and why I believe they will be the right choices for the country," she said.

Daisy Cooper, Treasury spokesperson for the Liberal Democrats, said: "It's clear that this Budget will be a bitter pill to swallow as the government seems to have run out of excuses."

Dharshini David: Reeves lays ground for painful Budget, but will it be worth it?

- Published2 hours ago

When is the Budget and what might be in it?

- Published1 hour ago

There are some in government who want this to be a one-and-done Budget, in that they do not want to come back again and again every year, eking out a bit more money in tax to meet the requirements of the independent forecast.

That is seen as an argument for raising billions of pounds through increasing at least one of the income tax rates.

However, it would be a big risk politically, especially with public trust in politics in general, and Prime Minister Sir Keir Starmer in particular, so low.

There is also the question of whether the prime minister and chancellor could land the argument that none of this was foreseeable before last year's Budget.

It comes as the Resolution Foundation, which has close links to Labour and was previously run by Treasury minister Torsten Bell, said avoiding changes to VAT, NI or income tax "would do more harm than good".

Its chief executive Ruth Curtice told the BBC "it was very unusual for a chancellor to make a speech three weeks before the Budget".

"It may simply be that there aren't enough sensible tax rises to raise the £25bn that we think she needs without touching those manifesto promises," she said.

The Resolution Foundation recommends hiking income tax as the "best option" for raising cash, but suggested it should be offset by a 2p cut to employee National Insurance, which would "raise £6bn overall while protecting most workers from this tax rise".

Raising the basic rate of income tax has been called the 50-year tax taboo. Labour's Denis Healey was the last chancellor to do this in 1975.

Extending the freeze in personal tax thresholds for two more years beyond April 2028 would also raise £7.5bn, the Resolution Foundation's pre-Budget analysis suggested.

The government's official forecaster, the Office for Budget Responsibility (OBR), is widely expected to downgrade its productivity forecasts for the UK at the end of the month. That could add as much as £20bn to the amount the chancellor will need to find if she is to meet her self-imposed "non-negotiable" rules for government finances.

The two main rules are:

Not to borrow to fund day-to-day public spending by the end of this parliament

To get government debt falling as a share of national income by the end of this parliament

Reeves said in her speech on Tuesday that her commitment to her fiscal rules was "iron-clad" and gave her clearest sign yet that she wants to increase her room for manoeuvre against shocks.

"There is a reward for getting these decisions right to build more resilient public finances with the headroom to withstand global turbulence, giving business the confidence to invest and leaving government freer to act when the situation calls for it," she said.

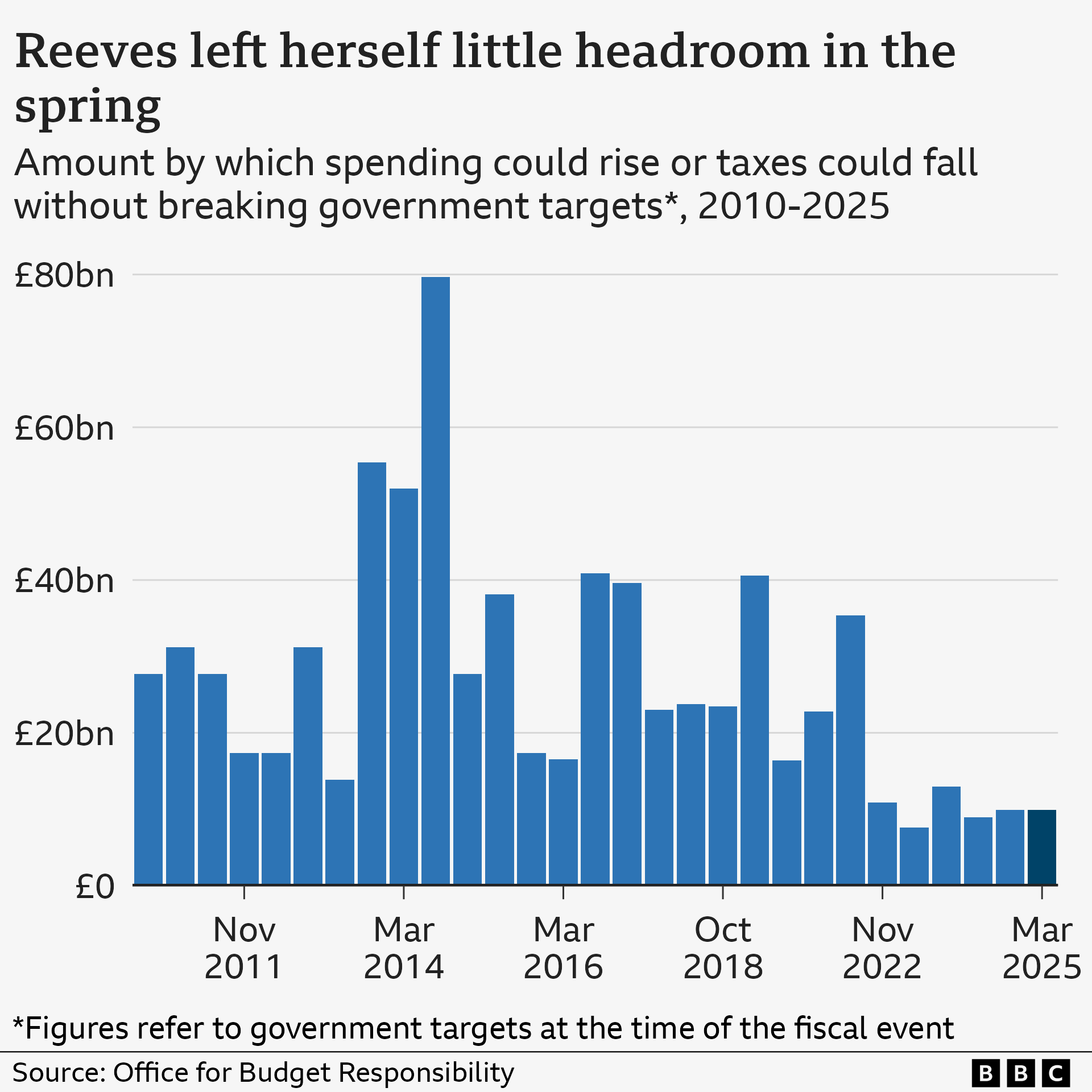

After the last Budget Reeves had £9.9bn of headroom, but the Resolution Foundation said subsequent policy U-turns and changes in the economic outlook have turned that into a £4bn black hole.

The group urged Reeves to double the level of headroom to £20bn in order to "send a clear message to markets that she is serious about fixing the public finances, which in turn should reduce medium-term borrowing costs and make future fiscal events less fraught".

Last month, the Institute for Fiscal Studies (IFS) said there was a "strong case" to increase fiscal headroom.

The think tank said the lack of a bigger buffer created instability, and could leave the chancellor "limping from one forecast to the next".