From cradle to stage: How Tsinghua University shapes China’s LLM scene

Dubbed China’s MIT, Tsinghua’s thriving “Tech Ecosystem” raises whether other Chinese universities can replicate its success.

0:00 / 0:00

Ni Tao is IE’s columnist, giving exclusive insight into China’s technology and engineering ecosystem. His Inside China column explores the issues that shape discussions and understanding about Chinese innovation, providing fresh perspectives not found elsewhere.

As 2024 comes to an end, a significant legal dispute has emerged in China’s large language model (LLM) industry.

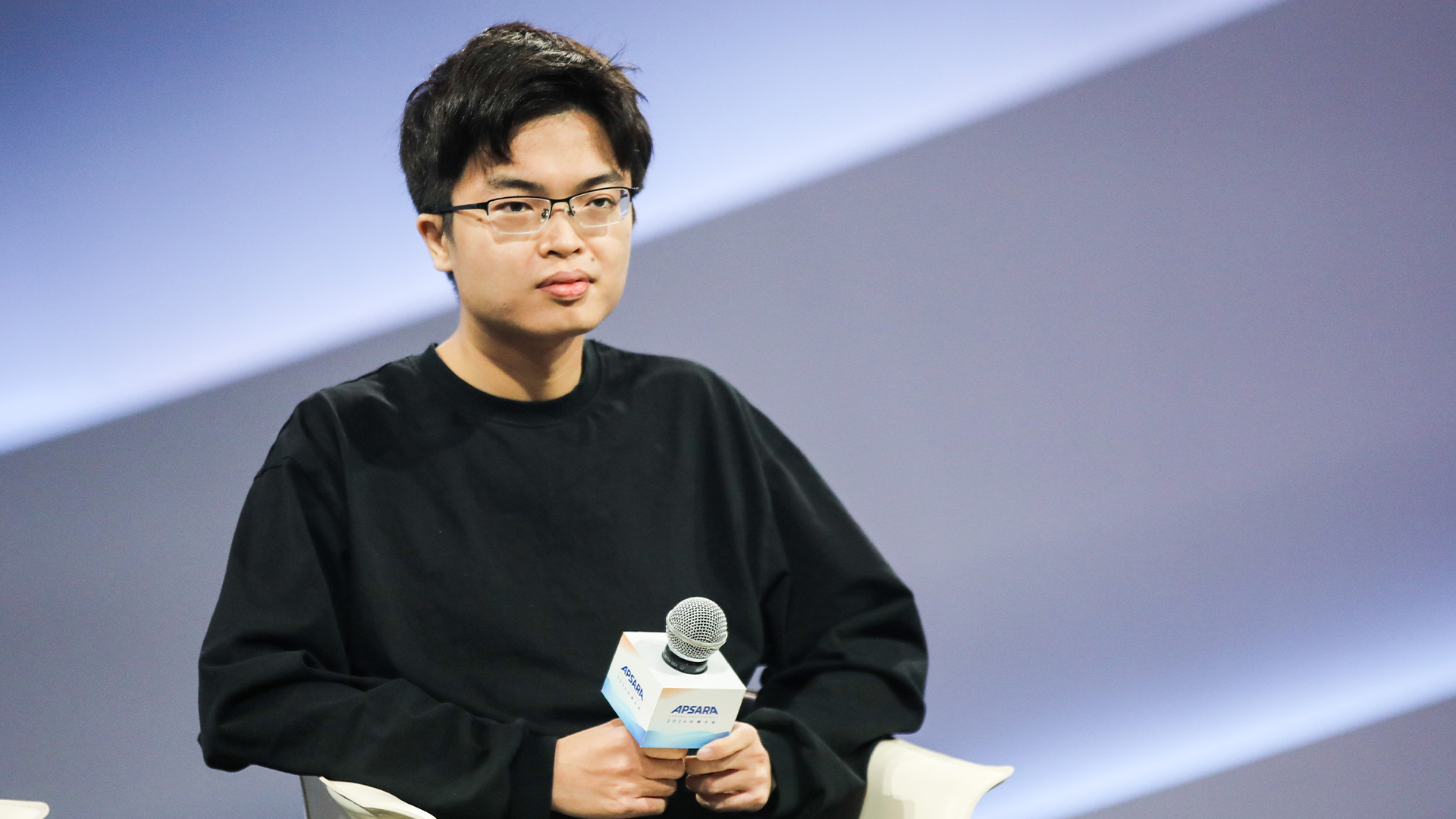

Yang Zhilin and Zhang Yutao, co-founders of the LLM unicorn Moonshot AI, are undergoing arbitration over allegations of breaching fiduciary duty in December. They are accused of failing to secure a waiver from previous investors of Recurrent AI, the sales tech company they founded.

Yang and Zhang left Recurrent AI to establish Moonshot AI in March 2023. A year later, the company boasts a valuation of 24 billion yuan ($3.3 billion).

Beyond this cause célèbre, another noteworthy aspect is the shared background of Yang and Zhang: both are Tsinghua University alumni and former students of renowned Tsinghua professor Tang Jie.

Tsinghua University is a cornerstone in China’s AI industry, particularly within the LLM sector. Widely regarded as the cradle of China’s LLMs, the university has cultivated an extensive talent pool and a cadre of researchers. It has also provided the necessary funding and ecosystem to support a thriving LLM space.

Conservative estimates suggest that at least 60 percent of founders in China’s top 100 LLM companies have ties to Tsinghua—whether as graduates, professors, or alumni. According to a 2023 report by the digital media outlet Zhidongxi, among 11 leading domestic LLM enterprises, 17 of their founders are connected to Tsinghua.

These 11 firms include some of China’s most prominent LLM companies: Moonshot AI, Baichuan AI, Zhipu, Shengshu Technology, and MiniMax, among others.

Their founders, without exception, share Tsinghua connections. For instance, Baichuan’s founder Wang Xiaochuan holds a master’s degree in information technology from Tsinghua. Zhipu’s founder, Tang Jie, is a Tsinghua professor who mentored Mooshot’s Yang and Zhang.

Shengshu’s founder, Zhu Jun, teaches at Tsinghua’s Department of Computer Science and Technology and is vice dean of its AI Institute. MiniMax’s founder Yan Junjie, formerly vice president at AI titan SenseTime, is also a Tsinghua postdoctoral scholar. Baichuan, Zhipu, MiniMax, and Moonshot AI are known as the “Four Dragons” of China’s LLM sector.

China’s LLM industry has gradually taken shape in the past three years. Alongside legacy LLMs from internet giants like Alibaba’s QWen, Huawei’s Pangol, and Baidu’s Ernie Bot, an increasing number of startups are distinctly marked by Tsinghua’s influence.

Academic commitment

Tsinghua’s reputation as China’s “Hall of Fame” for LLMs is rooted in several factors. To begin with, it is China’s top-ranked university for computer science, with investments in the field dating back to the 1970s and 1980s.

In 1978, Tsinghua’s Department of Automatic Control was renamed the Department of Computer Technology and Application to address the nation’s growing need for computer technology advancement. Concurrently, the university established an AI and Intelligent Control teaching and research group, marking the beginning of its AI-related undergraduate program.

Zhang Bo, one of the department’s early instructors and now an academician, recalled how Tsinghua’s initial AI curriculum was built upon textbooks photocopied and mailed back by visiting scholars abroad, “one book at a time.”

Despite its humble origins, Tsinghua identified several key AI research areas to focus on, including natural language processing, speech recognition, and intelligent control. A milestone in this AI journey was the establishment of the prestigious “Yao Class.”

With corporate sponsorship, Turing Award winner and renowned AI guru Andrew Chi-Chih Yao was invited to join Tsinghua’s faculty. From 2003 to 2006, Yao taught at Tsinghua, becoming a tenured professor and launching the esteemed “Yao Class,” or Tsinghua Teaching Lab for Computer Science. This program has since become a pipeline for China’s top AI talent.

The 2024 Artificial Intelligence Index Report, released by Stanford University professor Fei-Fei Li and her team, highlights Tsinghua as the leading non-Western institution in foundational model publications, having launched seven such models.

Financing strengths

LLMs require significant talent, technology, and capital investments, raising the bar for startups. Developing LLMs is exceedingly expensive, with funding rounds often hundreds of millions to billions of yuan. Within this challenging landscape, Tsinghua-affiliated startups have emerged as dominant players in China’s LLM industry.

Tsinghua professors and alumni entrepreneurs are undeniably attractive to investors. More crucially, Tsinghua-backed venture funds and alumni-driven financial backers have formed a solid foundation of support for the university’s LLM ventures.

According to IT Juzi, a market intelligence provider, by 2022, Tsinghua alumni had built an expansive entrepreneurial and investment network comprising 1,632 entrepreneurs and 633 investors. This network creates a robust financing ecosystem for Tsinghua-affiliated entrepreneurs.

Beyond institutional investors, prominent Tsinghua alumni have also been instrumental in this drive. For example, Wang Xing, founder and CEO of food delivery app Meituan, has invested in numerous LLM companies, including Zhipu and Baichuan AI.

In venture capital, early-stage investments often rely on trust. Many investors favor Tsinghua-affiliated founders, viewing them as pragmatic, diligent, and grounded. However, the focus shifts to the portfolio company’s intrinsic value in later funding stages.

Nonetheless, Tsinghua’s extensive alumni network and influence in the capital market have consistently provided substantial financial backing for Tsinghua-backed LLM startups.

Can the Tsinghua model be replicated?

Tsinghua is often likened to China’s MIT. Its STEM graduates are highly active in industries such as LLMs, AI, autonomous driving, and robotics, creating what is known as the “Tsinghua Tech Ecosystem.” But can Tsinghua’s model of success be replicated by other Chinese universities?

The emergence of the Tsinghua ecosystem highlights a notable trend: an increasing number of top-tier talent and young scientists are stepping out of ivory towers into the industry, transforming technological breakthroughs into practical applications.

In the near term, few domestic universities can rival Tsinghua’s dominant position in the LLM sector. Building such expertise demands time, a substantial investment, and a comprehensive ecosystem.

While elite institutions like Peking, Zhejiang, and Shanghai Jiao Tong universities strive to catch up through prolific research output, the development of China’s LLM industry is expected to carry a distinct “Tsinghua imprint” for the foreseeable future. Therefore, examining Tsinghua’s leadership provides key insight into the future of China’s LLM sector.

One significant trend is the divergence within China’s LLM community on the path forward. On one side are tech experts who champion Artificial General Intelligence and the Scaling Law.

They argue that advancing model capabilities and reducing costs will unlock vast new applications. To them, failing to pursue “bigger and stronger AI capabilities” risks being overtaken by competitors with superior models.

On the other side are market believers who contend that the steep technology curve in LLMs will eventually level off. Instead, they emphasize deploying AI models in commercial settings for quick monetization, leveraging China’s vast and unique datasets to build competitive advantages. This group prioritizes practical applications and actively integrates LLMs into various industries to boost productivity.

Diverging strategies

The development of LLMs hinges on immense computational power, talent, and funding, positioning China and the US as leaders in this race. However, their strategies differ significantly.

China is in constant danger of losing access to AI chip imports from the US. This has severely eroded its computational power, causing it to fall behind in the LLM race.

Strategically, their goals are also different. The US, with players like OpenAI, Gemini, and Llama, sets its sights on general-purpose foundational models, while China emphasizes application and commercialization.

Chinese tech giants like Baidu, Alibaba, and Huawei have actively developed industry-specific LLMs derived from general-purpose models. At the same time, startups bet on specialized models for sectors like finance, healthcare, governance, and education.

This two-stage approach involves pre-training general models and fine-tuning them with industry-specific data to create “industry LLMs.” Industry-specific LLMs have a lower technical barrier due to open-source tools and frameworks, making them accessible for practical applications.

In contrast, general-purpose models require vast resources, datasets, and expertise—affordable only for tech giants like ByteDance, which reportedly purchased 230,000 Nvidia GPUs in 2024, second only to Microsoft. ByteDance plans to double its AI expenditure to a whopping 160 billion yuan in 2025.

While industry-specific models are practical, they are limited to narrow applications and lack generalized capabilities. For instance, Zhou Bowen, a Tsinghua professor and founder of LLM startup Frontis, once faced criticism for his “narrow” fixation on consumer goods supply chains.

In China, general-purpose LLM remains the domain of tech giants, while startups tend to solve specific business problems with smaller models. This dual approach is expected to dominate China’s LLM landscape for months.

Globally, China has trailed the US in LLMs. Fei-Fei Li’s 2024 Artificial Intelligence Index Report shows that the US produced 61 major AI models in 2023, compared to China’s 15.

Academician Zhang Bo acknowledged a widening gap between China and the US in LLMs, primarily due to “disparities in top-tier talent.”

While Tsinghua has nurtured generations of AI talent, a new challenge lies ahead: helping these individuals shine even brighter on the global stage.

Recommended Articles

0COMMENT

ByNi Tao

Ni Tao worked with state-owned Chinese media for over a decade before he decided to quit and venture down the rabbit hole of mass communication and part-time teaching. Toward the end of his stint as a journalist, he developed a keen interest in China's booming tech ecosystem. Since then, he has been an avid follower of news from sectors like robotics, AI, autonomous driving, intelligent hardware, and eVTOL. When he's not writing, you can expect him to be on his beloved Yanagisawa saxophones, trying to play some jazz riffs, often in vain and occasionally against the protests of an angry neighbor.

- 1US: Last Energy raises funds to mass produce steel-encased micro nuclear reactors

- 2China: World’s largest-diameter boring machine reaches 6-mile tunneling milestone

- 3Sweden unveils Europe's first car park constructed using recycled turbine blades

- 4China's ultra-hot heat pump could turn sunlight into 2,372°F thermal power for industries

- 5Solar storm could cripple Elon Musk's Starlink satellites, causing orbital chaos