The global platform for specialist media

Future is a global platform for intent-led specialist media underpinned by proprietary technology and enabled by data, with diversified revenue streams. Our leadership position is delivered by strong, consistent organic growth and accelerated through acquisitions.

Latest resultsFinancial highlights

financial highlights

FY 2025

-6%

Revenue to £739.2m

-8%

Adjusted operating profit of £205.4m

86%

Adjusted Free Cash Flow conversion £177.0m

-3%

Organic growth

-1%

Adjusted EPS 123.0p

1.3x

Leverage. Net debt £276.4m

HY 2025

-3%

Revenue to £378.4m

-5%

Adjusted operating profit of £100.7m

-12%

Adjusted Free Cash Flow of £111.5m

FLAT

Adjusted operating margin of 27%

-1%

Organic revenue growth

+4%

Adjusted diluted EPS of 59.7p

The Future strategy

We connect audiences to their passions through the content we create, the innovative technology we pioneer and the engaging experiences we deliver. Our leadership position is underpinned by strong, consistent organic growth, accelerated through acquisitions, and supported by a strong monetisation strategy. At the heart of what we do are our purpose, values and culture.

Our strategy is simple, creating internal alignment to ensure flawless execution and agility, allowing us to pivot and lean into areas of opportunity in an ever changing ecosystem: it is timeless. Our strategy is broken down into three objectives:

Audience (reach & attract)

WHY: our audiences are the lifeblood of our business model, central to our purpose. Our business is a function of audience and monetisation, so attracting audiences is essential to drive sustainable growth.

HOW:

Expert and trusted content is paramount to reach audiences. Especially with the rise of AI through generic summarisation and fake news, producing quality, expert and trustworthy content is of the utmost importance. This is also how we reinforce the quality of our brands, making them go-to for their area of expertise, making them influential across platforms including on large language models (LLMs).

Audience diversification: audiences are not static. How they consume and engage with our expert content evolves. As a result it is paramount to remain platform-agnostic and produce content in whichever form users would like to consume. This is about understanding the users, and providing them with a valuable proposition, which is why we continually look at ways to diversify our audience sources to ensure sustainability.

Monetisation (diversify & grow)

WHY: in a disruptive industry, diversification is a synonym for sustainability and relevance: the way we make money today is not the same as ten years ago and won’t be the same in ten years time. We must continue to create new revenue streams from new audiences and new revenue that does not require an audience.

HOW: by leveraging our innovative mindset, creating new products, targeting growing adjacencies and market opportunities such as artificial intelligence (AI).

Portfolio (optimise)

WHY: in an ever-changing environment, we ensure that the portfolio we operate is fit for purpose, poised for growth and/or cash generative. We are unemotional about the assets that we own and therefore focused on creating value for stakeholders.

HOW: our portfolio is regularly reviewed against criteria including growth profile, profitability, cash generation, and strategic opportunities. Assets that are no longer fit for purpose are closed. Additionally, and in line with our capital allocation, we aim to accelerate our strategic initiatives through acquisitions. We assess these against strict financial hurdles to ensure the strategic fit is matched with financial metrics.

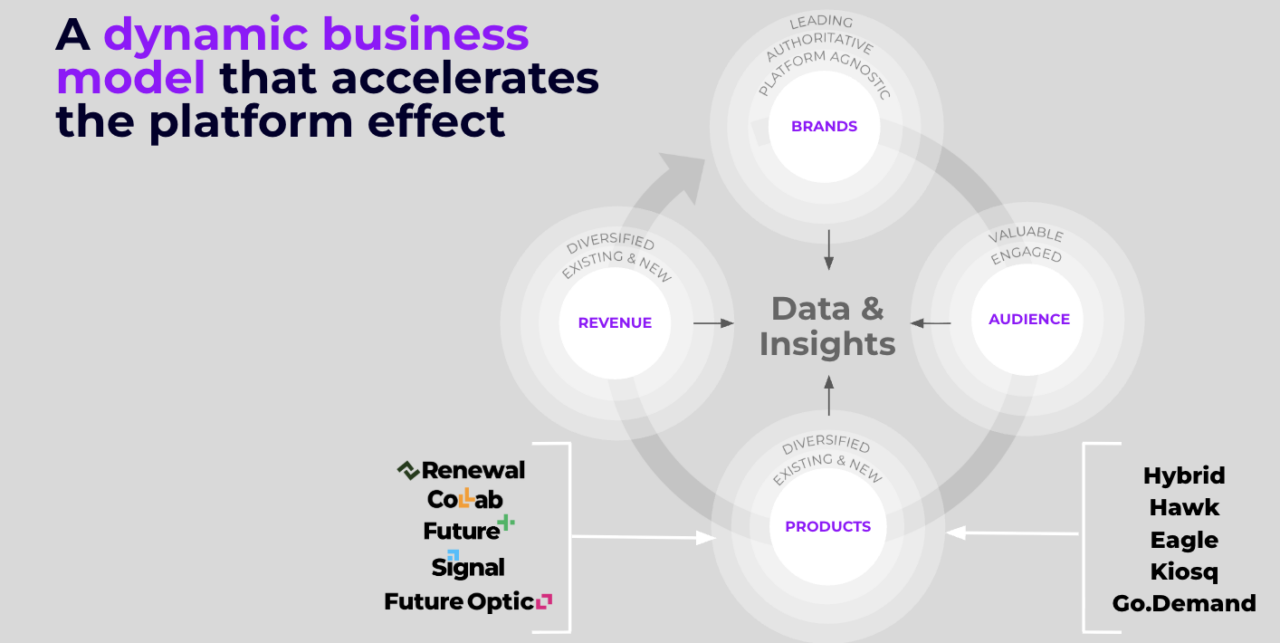

The more we drive strategic initiatives and revenue, the more powerful and valuable the platform becomes, creating a flywheel.

It all starts with brands and content to reach and pull in the audience, in a diversified manner. Brands that produce quality content in a platform-agnostic way, across diversified formats that are ranking across the search ecosystem from SEO to LLMs.

Next we apply a growing set of innovative products to further drive engagement, brand stickiness and clear value exchange with our customers and clients.

Finally, we then monetise through diverse routes: from print to digital subscriptions, newsstand, down to email and display and video advertising. Over time we are further diversifying our monetisation routes.

Alongside each moment, we capture more data, which in turn is used to perfect our products and content and further drive monetisation.

OUR PROPRIETARY TECHNOLOGY IS A UNIQUE FEATURE OF THE GROUP:

01

Vanilla

Is our single modular web platform, it has a single content management system

02

Hawk

Is our eCommerce service that enables the monetisation of our content through product affiliates

03

Hybrid

Is our advertising system and is a server side open auction marketplace dealing with yield management

04

GoDemand

Is our eCommerce service that enables the monetisation of our content through product affiliates

05

Aperture

Is our customer audience data platform

06

SmartBrief

Is our email curation and delivery platform for email products, offering hyper audience cohort targeting and advertising capabilities

07

Kiosq

Is our new proprietary reusable paywall service for monetisating gated editorial content

08

Eagle

Is our proprietary voucher technology

Capital allocation enables efficient value-creation cycle

The diagram to the right depicts our capital allocation framework, showing the hierarchy of priorities we consider to deploy our capital. We review this regularly to ensure it remains appropriate in current market conditions.

First, the Group is highly cash generative with ~95% of adjusted free cash flow conversion to adjusted operating profit.

- Our primary focus is on organic growth as a priority, re-investing into the business with capex planned at ~3% of revenue. Where appropriate, we then leverage our strong cash flows to create value through M&A.

- Then, Future adopts a disciplined and rigorous approach to bolt-on acquisitions and will only pursue an acquisition where there is a compelling rationale, i.e. the acquisition has to offer either (1) diversification across new verticals, (2) new products, or (3) new technology, skills or capabilities.

- We believe that strategic M&A can be a great long-term value creation opportunity for shareholders. It remains a core strategic lever going forward. However, in current market conditions, strategic M&A box is not an immediate focus.

- Our next priority is returning cash to shareholders. We have announced our proposal to increase the current dividend to 17.0p, a 5x increase, reflecting a dividend yield in line with market average and a testament to the Group’s confidence in the long-term.

- Finally, in order to maintain a minimum leverage of one time, any excess cash will be returned to shareholders through share buybacks. At the beginning of 2025, we completed our second share buyback programme, followed by a third programme which completed in July and a fourth programme of up to £55m which is currently underway, totalling £99.5m returned to shareholders during the year (buybacks and dividend). The Board has announced a fifth programme of up to £30m.

- Going forward, we will continue to follow this framework, reviewing priorities in light of market conditions to maximise our opportunities.

01

Organic investment to support the ongoing growth in business

02

M&A to add content and/or capabilities

03

De-leveraging to provide flexibility to capitalise on growth opportunities

04

Shareholder returns (annual progressive dividend and share buyback)

| Date | Name | Content/Capability |

|---|---|---|

| January 2026 | SheerLuxe | Fashion & Beauty Video & podcast capabilities, Google zero |

| May 2025 | Kwizly | Engagement tool |

| March 2025 | RNWL | Insurance wallet app |

| February 2023 | Gardening Know How | Lifestyle & Homes in North America |

| December 2022 | ActualTech Media | Lead & content generation |

| October 2022 | ShortList | Technology & Lifestyle |

| June 2022 | Who What Wear | Women's lifestyle in North America Social monetisation |

| March 2022 | WhatCulture | Gaming & Entertainment Video monetisation on social platforms |

| February 2022 | Waive | Data predictive analytics |

| 1 October 2021 | Dennis | Enhance/scale the Wealth B2B pro technology, and Knowledge verticals Increase recurring revenue, subscription and lead generation capabilities |

| 12 May 2021 | Marie Claire US | Women’s lifestyle in North America |

| 17 February 2021 | GoCo group plc | Price comparison (PCW) for services, further eCommerce with MyVoucherCodes Home and personal wealth |

| 2 February 2021 | Mozo | Price comparison (PCW) for services |

| 1 October 2020 | CinemaBlend | TV and entertainment in the US |

| 20 April 2020 | TI Media | Many new verticals including women’s lifestyle and TV |

| 15 November 2019 | Barcroft Studios | New TV & digital video production revenue stream |

| 29 July 2019 | SmartBrief | New B2B email newsletter revenue stream |

| 1 March 2019 | Mobile Nations (MoNa) | Significant increase in online tech portfolio |

| 13 February 2019 | Cycling | Boosts sports vertical with new cycling brands |

| September 2018 | Purch Consumer | Significant increase in online tech and science portfolio and US reach |

| May 2018 | Haymarket Consumer | New sports vertical boosts tech online reach |

| April 2018 | NewBay Media | New B2B brands, increased reach in US |

| August 2017 | Home Interest | New home interest vertical |

| January 2017 | Team Rock | New knowledge verticals |

| October 2016 | Imagine | New knowledge verticals |

We maximise value for all our stakeholders

Audience - Our audiences value our expert content.

Customers - Our value proposition satisfies our customers thanks to our rich first-party data, our scale and our expertise.

Employees - It's the people in the boat that matter and success feels good are part of our values.

Shareholders - Successful execution of the strategy drives strong earnings performance.

Communities - We are part of the communities and we are keen to make a difference.

Analysts and consensus

Analysts & consensus

Over 175 brands with expertise, authority and trust

Our brands span a diverse range of verticals that deliver expert content our audiences love.

See our brands